Loading

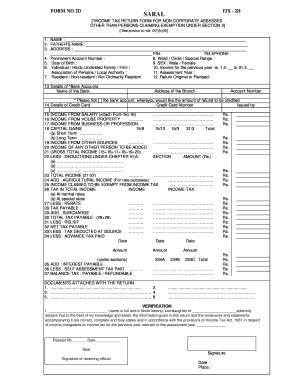

Get Form No 2d Its - 2d Saral - Doda Nic

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FORM NO 2D ITS - 2D SARAL - Doda Nic online

Filling out the FORM NO 2D ITS - 2D SARAL - Doda Nic is an essential part of the income tax return process for non-corporate assesses. This guide provides clear and step-by-step instructions to help users successfully complete the form online.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to retrieve the form and open it in the online editor.

- Begin with the personal information section. Enter your name, father's name, and complete address including the PIN code and telephone number.

- Provide your Permanent Account Number (PAN) and indicate your ward, circle, or special range.

- Fill in your date of birth, select your status as an individual, Hindu Undivided Family, firm, or other specified category.

- Indicate whether you are a resident, non-resident, or not ordinarily resident.

- Specify if the return is original or revised.

- List details of your bank accounts, including the bank's name, branch address, and account number. Mark the account for refunds.

- Provide information regarding your credit card, if applicable, including the credit card number and issuing entity.

- Proceed to report your income sources: fill in details for income from salary, house property, business or profession, capital gains, and other sources.

- Sum up your gross total income by totaling all reported incomes and including any income of other persons to be added.

- List any deductions you are claiming under Chapter VI-A and calculate your total income by subtracting deductions from your gross total income.

- Calculate the tax based on your total income, considering normal and special rates.

- Account for any rebates and surcharges to finalize total tax payable.

- Report any tax deducted at source and advance tax paid, and determine your balance tax payable or refundable.

- Attach necessary documents as specified, indicating each in the provided section.

- Complete the verification section by declaring that the information is accurate, and sign the form.

- After filling out the form, ensure to save your changes, then download, print, or share the completed form as needed.

Start filling out your FORM NO 2D ITS - 2D SARAL - Doda Nic online today!

Selecting between ITR Form 1 or 2 depends on your income sources. If your income is solely from salary and you've no other income, ITR Form 1 suffices. However, if you have multiple income sources or own a house property, ITR Form 2 is the correct choice; FORM NO 2D ITS - 2D SARAL - Doda Nic can assist in making this decision clearer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.