Loading

Get W 8ben Chase 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 8ben Chase online

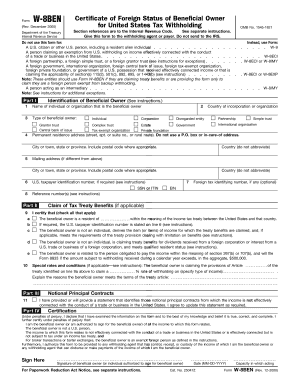

The W 8BEN form is essential for foreign individuals and entities to certify their foreign status for U.S. tax withholding purposes. This guide provides detailed instructions to assist you in completing the W 8BEN form online.

Follow the steps to accurately fill out your W 8BEN form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter the name of the individual or organization that is the beneficial owner in the designated field.

- Indicate the type of beneficial owner by selecting from the options provided, such as individual, corporation, or partnership.

- Fill in the country of incorporation or organization, ensuring you provide the correct information.

- Provide the permanent residence address, including street, city or town, state or province, and postal code. Do not use a P.O. box.

- If there is a different mailing address, complete that section with the necessary details.

- If required, include the U.S. taxpayer identification number in the appropriate field; otherwise, fill in the foreign tax identifying number if applicable.

- In Part II, check the applicable boxes to certify your residency status and other necessary information related to tax treaty benefits.

- If claiming special rates, provide the details regarding the type of income and the rate of withholding as specified in the treaty.

- In Part IV, certify the information provided by signing the form, entering the date, and indicating your capacity if acting on behalf of the beneficial owner.

- Finally, review the completed form for accuracy, then save changes, download, print, or share the form as needed.

Start filling out your W 8BEN form online today to ensure proper foreign status certification.

You likely received a W-8BEN form because you have U.S. source income, and your bank or financial institution, like Chase, needs to verify your foreign status. This form allows you to claim any applicable tax treaty benefits and ensures that you are not subjected to excessive withholding taxes. Completing this form is essential for proper tax treatment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.