Get Motor Vehiclrs For Orthopedically Handicapped Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Motor Vehiclrs For Orthopedically Handicapped Form online

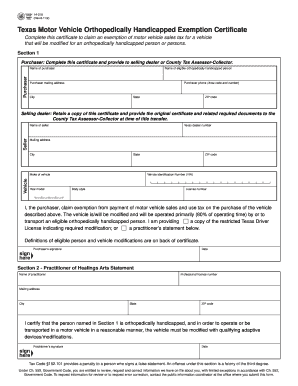

Understanding how to accurately complete the Motor Vehiclrs For Orthopedically Handicapped Form is essential for claiming an exemption from motor vehicle sales tax. This guide provides step-by-step instructions tailored to users of all experience levels, ensuring a streamlined online process.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the Motor Vehiclrs For Orthopedically Handicapped Form in your browser.

- Begin filling out Section 1 by providing your details as the purchaser. Include your full name, the name of the eligible person with an orthopedic handicap, and your mailing address. Additionally, enter your phone number, city, state, and ZIP code.

- Fill in the details of the selling dealer, including their name, Texas dealer number, and mailing address, along with city and state information for proper identification.

- In the vehicle section, complete the necessary fields: indicate the make, year model, and Vehicle Identification Number (VIN) of the vehicle you are planning to purchase. Ensure to provide the body style and license number as required.

- Sign and date the form at the designated area to confirm your claim for the exemption based on the modification requirements for the vehicle. Also, ensure you are providing the necessary documentation, whether it is a restricted Texas driver license or a practitioner's statement.

- Proceed to Section 2, where the licensed practitioner must fill out their information, including their name, professional license number, mailing address, and signature, certifying the orthopedic handicap of the eligible person.

- After completing all sections, review the form for accuracy. Save your changes and choose to download or print the completed form for your records. You may also share it as needed with the selling dealer or County Tax Assessor-Collector.

Start filling out your Motor Vehiclrs For Orthopedically Handicapped Form online now.

In Texas, disabled veterans may qualify for exemptions from property taxes. These exemptions apply to the homes of veterans with certain disabilities and can significantly reduce their tax burden. Additionally, veterans who use the Motor Vehicles For Orthopedically Handicapped Form may also benefit from possible exemptions on vehicle taxes. It's essential to review your eligibility to take full advantage of these benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.