Loading

Get Ca25 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ca25 Form online

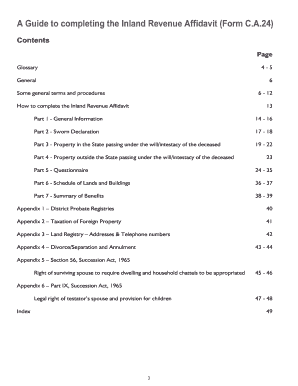

The Ca25 Form is essential for personal representatives to report the assets and liabilities of a deceased individual to the Revenue Commissioners. This guide will provide a clear, step-by-step process to help you complete the form accurately and efficiently online.

Follow the steps to complete the Ca25 Form online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling in the General Information section. Provide the deceased's full name, PPS Number, address, and date of death.

- Complete the occupation and place of death details, ensuring all information matches official documents like the death certificate.

- Indicate the deceased's domicile, and whether they were resident or ordinarily resident in the state at the date of death.

- Provide the marital status of the deceased, including ticking any relevant options available.

- In the Sworn Declaration section, enter the names and information of personal representatives, checking the type of grant being applied for, whether it’s Probate or Administration.

- Attach any required documents like a copy of the Will or Codicil, if applicable, to the form.

- Fill out Part 3 for Property in the State passing under the will or intestacy, listing all real estate, personal property, and other assets, providing their gross market values.

- Proceed to Part 4 for Property outside the State, repeating similar information for foreign assets.

- Complete the Questionnaire in Part 5 by answering all questions appropriately and supplying any necessary details.

- In Part 6, list details of Lands and Buildings, ensuring to classify them accurately and provide market values.

- Finalize your entries in Part 7 by summarizing benefits, noting beneficiary details and ensuring all data is correct before submission.

- Once all sections are completed and reviewed, save changes and choose options to download, print, or share the completed form.

Get started on completing the Ca25 Form online today!

Filing Form 15CA online involves accessing the designated tax portal and completing the online application carefully. You’ll need to ensure that you have all relevant information regarding the payment and the recipient. After completing the form, review it for any inaccuracies before submission. For assistance, you can rely on uslegalforms to help walk you through specifics related to the Ca25 Form and ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.