Loading

Get Form 451a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 451a online

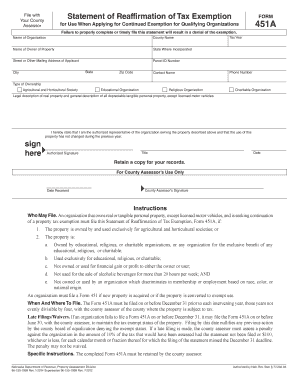

Filling out Form 451a is a crucial step for organizations seeking to maintain their property tax exemption. This guide provides a clear and supportive approach to help users navigate each section of the form effectively and ensure its proper completion online.

Follow the steps to complete Form 451a successfully

- Press the ‘Get Form’ button to access the form and open it for editing.

- Start by entering the name of your organization in the designated field. Be sure to use the official name used during incorporation.

- Specify the county name where the property is located; double-check for accuracy to avoid potential issues.

- Fill in the name of the property owner, ensuring it matches legal documentation.

- Indicate the state where your organization is incorporated.

- Provide the complete street or mailing address of the applicant for correspondence.

- Input the parcel ID number associated with the property for identification purposes.

- Fill out the city and zip code related to the property location.

- Enter the contact name of someone who can be reached regarding this form.

- Select the tax year for which the exemption is being reaffirmed.

- Add the phone number of the primary contact person for any follow-up.

- Choose the type of ownership from the provided options: Agricultural and horticultural society, educational organization, religious organization, charitable organization.

- Provide a legal description of the real property along with a general description of any tangible personal property owned, excluding licensed motor vehicles.

- Confirm your status as the authorized representative of the organization by marking the statement.

- Sign in the designated area to validate your submission, include your title, and date the document.

- After completing the form, save your changes, and consider downloading, printing, or sharing it as necessary.

Begin completing your Form 451a online today to ensure your continued tax exemption.

The S4 tax exemption in Georgia offers property tax relief for low-income homeowners and seniors. This exemption aims to alleviate financial burdens and make homeownership more accessible. Residents looking to qualify for this exemption should file the appropriate documentation, which may include Form 451a. Utilizing such exemptions can enhance your financial well-being by reducing tax liabilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.