Loading

Get 538s Form 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 538s Form 2019 online

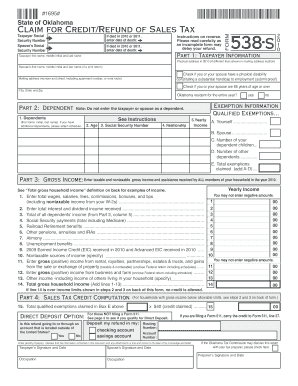

Filling out the 538s Form 2019 online is an essential process for individuals seeking a refund of sales tax in Oklahoma. This guide provides clear and detailed instructions to ensure you successfully complete the form with accuracy and ease.

Follow the steps to fill out the 538s Form 2019 online.

- Click 'Get Form' button to obtain the form and open it in your editor.

- Enter the taxpayer's first name, middle initial, and last name in the designated fields. Include the Social Security number and the spouse's Social Security number if applicable.

- Provide the physical address in 2010 if it differs from the mailing address section. Confirm or provide the spouse's details if filing jointly.

- Indicate if you or your spouse have a physical disability that constitutes a substantial handicap to employment, and remember to submit proof.

- Fill in the mailing address, including the apartment number or rural route if necessary, along with the city, state, and zip code.

- In Part 2, declare if you are an Oklahoma resident for the entire year and list your dependents' details such as their names, ages, Social Security numbers, and relationships.

- Proceed to Part 3 and document all taxable and nontaxable gross income for all household members for 2010. Be thorough in your entries to avoid delays.

- In Part 4, calculate the sales tax credit, ensuring to specify whether the refund will go to an account located outside the United States.

- Complete the direct deposit option section if desired, providing your bank account information for the refund.

- Review all sections to ensure all information is accurate and complete before signing and dating the form. Ensure any necessary proof is attached.

- Finally, save the changes, and download or print the completed form for your records. Be sure to submit it to the appropriate tax authority by the deadline.

Start filling out the 538s Form 2019 online today to ensure you receive your sales tax refund promptly.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. Tax credits reduce the amount of income tax you owe to the federal and state governments. ... In most cases, credits cover expenses you pay during the year and have requirements you must satisfy before you can claim them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.