Loading

Get Form 1120 Schedule G

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1120 Schedule G online

Filling out Form 1120 Schedule G is an essential task for corporations that have specific types of entities or individuals owning their voting stock. This guide provides clear, step-by-step instructions on how to complete this form online with ease.

Follow the steps to complete your Form 1120 Schedule G online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

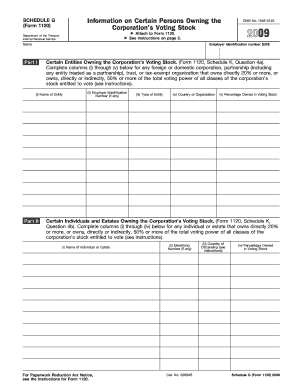

- Begin with the identification section. Enter the name of your corporation and its Employer Identification Number (EIN) at the top of the form.

- Navigate to Part I, which pertains to certain entities owning voting stock. Complete columns (i) through (v) for each entity that owns 20% or more directly, or 50% or more directly or indirectly, of the corporation’s voting power. Details to provide include: (i) Name of entity, (ii) Employer Identification Number (if applicable), (iii) Type of entity (corporation, partnership, etc.), (iv) Country of organization, and (v) Percentage owned in voting stock.

- Move to Part II, which focuses on individuals and estates that own the corporation’s voting stock. Fill in columns (i) through (iv) for each individual or estate that owns 20% directly, or 50% directly or indirectly. Information required includes: (i) Name of individual or estate, (ii) Identifying number (if available), (iii) Country of citizenship, and (iv) Percentage owned in voting stock.

- Review all entries for accuracy and completeness. Ensure that all entities and individuals who meet the ownership thresholds are accounted for in their respective sections.

- Finalize your form: save your changes, and when ready, download, print, or share the completed form as required.

Start filling out your Form 1120 Schedule G online today to ensure compliance and accuracy in your corporate filings.

The purpose of Schedule G is to report information regarding certain types of income and deductions that are pertinent to a corporation's tax situation. This schedule helps the IRS evaluate the company's financial practices more effectively. Utilizing Schedule G on Form 1120 is beneficial for ensuring that your corporation meets tax obligations smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.