Get Subrogation Receipt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Subrogation Receipt online

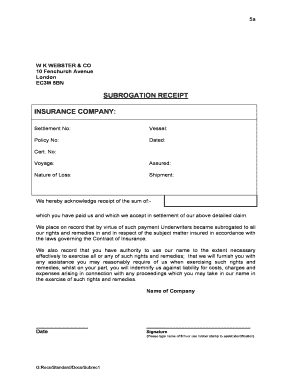

Filling out the Subrogation Receipt online can simplify your claims process by ensuring all necessary information is accurately recorded. This guide will provide a clear and structured approach to completing the form seamlessly.

Follow the steps to complete your Subrogation Receipt online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the insurance company in the designated field to identify the insurer overseeing the settlement.

- Fill in the settlement number, which corresponds to the specific claim you are processing.

- Indicate the vessel involved in the claim, providing its name to clarify the context of the settlement.

- Input the policy number associated with the insurance plan relevant to the claim.

- Record the date on which the settlement is being formally acknowledged.

- Include the certificate number, which serves as a reference for the documentation.

- Specify the voyage details related to the insurance coverage for further clarity on the claim.

- Enter the name of the assured party, which is the person or entity covered by the insurance.

- Describe the nature of the loss in the provided space, outlining the circumstances that led to the claim.

- Specify the shipment details that relate to the insured item, ensuring that all information is accurate and complete.

- Acknowledge the receipt of the payment by entering the amount you have been paid as settlement for the claim.

- Type the name of the company in the designated area to confirm the entity that is acknowledging the receipt.

- Enter the date on which the receipt is being completed, ensuring it aligns with the rest of the documentation.

- Provide a signature by typing the name of the firm or using a rubber stamp for identification purposes.

- Once the form is filled out, save changes, download, print, or share the completed document according to your needs.

Complete your documents online efficiently and securely today.

The two main types of subrogation are conventional and equitable subrogation. Conventional subrogation occurs when there is an explicit agreement between the insurer and the insured regarding the right to recover costs, often outlined in the policy. Equitable subrogation, on the other hand, arises by law, allowing insurers to recover costs without a specific agreement. Understanding these distinctions, especially in light of a subrogation receipt, can improve your financial literacy regarding insurance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.