Loading

Get Get The T2151 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Get The T2151 Form online

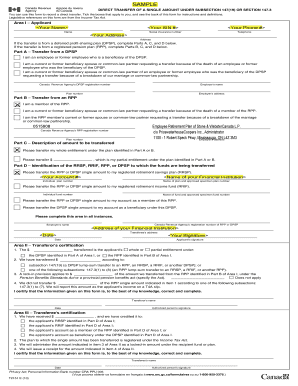

This guide provides a detailed walkthrough for filling out the Get The T2151 Form online. Designed for individuals looking to record a direct transfer under the Income Tax Act, this resource will help you navigate each section of the form with clarity and precision.

Follow the steps to complete the Get The T2151 Form online.

- Press the ‘Get Form’ button to retrieve the T2151 Form and open it for editing.

- In Area I, fill out your personal details, including your name, social insurance number (SIN), phone number, and address.

- Determine the transfer type by checking the appropriate boxes in Parts A or B based on whether you are transferring from a deferred profit-sharing plan (DPSP) or a registered pension plan (RPP). Fill in additional details required for the selected plan.

- In Part C, specify the amount to be transferred. You can either choose to transfer your whole entitlement or a partial amount.

- In Part D, indicate the account or plan to which the funds are being transferred, filling out the required details for your registered retirement savings plan (RRSP), registered retirement income fund (RRIF), or other applicable accounts.

- Review all information for accuracy and completeness.

- Finally, save the form, and choose whether to download, print, or share it as needed.

Start filling out your documents online today for a smoother process.

Related links form

CRA stands for Canada Revenue Agency, which is the governmental agency responsible for tax collection and tax law enforcement in Canada. Understanding the role of the CRA is essential for tax compliance and benefits. If you need to interact with the CRA regarding tax forms, such as getting the T2151 Form, you can find helpful resources on uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.