Loading

Get 2001 Form 540nr, California Nonresident Or Part-year Resident ... - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

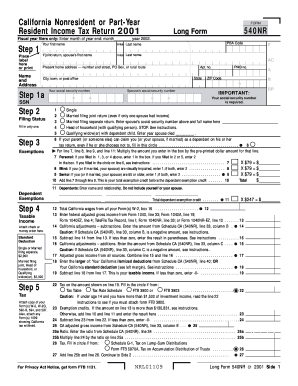

How to fill out the 2001 Form 540NR, California Nonresident or Part-Year Resident online

This guide will walk you through the process of filling out the 2001 Form 540NR, designed for California nonresidents or part-year residents. Follow these step-by-step instructions to ensure accurate and complete submission.

Follow the steps to successfully complete your tax form.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter your name and address in the designated fields. Ensure accuracy with your first name, last name, and current residential address.

- Provide your social security number (SSN) in the appropriate section. If you are filing jointly, include your partner's SSN as well.

- Select your filing status by marking only one option among single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Complete the exemptions section by indicating the number of exemptions you and your partner may claim, including any dependents.

- Proceed to fill out the taxable income section by recording your total California wages and adjusting your federal adjusted gross income as required.

- Calculate your total tax by entering the tax rates and applying any credits you are eligible for.

- Complete the payments section, including any California income tax withheld or prior estimated tax payments.

- Review any overpayments or tax due, ensuring that all calculations are accurate and reflect your financial situation.

- Finalize the document by signing and dating it at the bottom of the form. Ensure all necessary attachments are included.

- After verifying all details and calculations, you may save your changes, download the completed form, print it, or share it as needed.

Complete your 2001 Form 540NR online to streamline your tax filing process.

The primary difference between CA Form 540 and 540NR lies in residency status. Form 540 is for full-time residents, while the 2001 Form 540NR, California Nonresident Or Part-Year Resident ... - Ftb Ca caters to non-residents and part-year residents. This distinction affects which income is reported and how taxes are calculated. Choosing the correct form is vital for compliance with California tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.