Loading

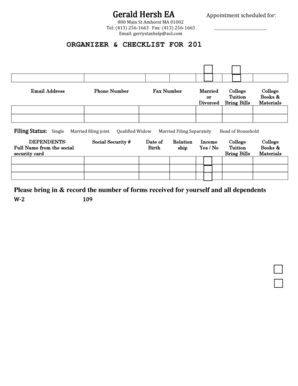

Get Organizer & Checklist For 201 Taxes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ORGANIZER & CHECKLIST FOR 201 TAXES online

This guide will assist you in completing the ORGANIZER & CHECKLIST FOR 201 TAXES form online. By following the steps outlined below, you will effectively gather and organize all necessary information needed for your tax filings.

Follow the steps to successfully fill out the form online.

- Click the ‘Get Form’ button to access the ORGANIZER & CHECKLIST FOR 201 TAXES document and open it in your preferred digital document editor.

- Enter your personal information in the designated fields, including your name, social security number, phone number, email address, and filing status. Ensure all details are accurate and up-to-date.

- Provide information about dependents, including their full names and social security numbers, if applicable. Include details regarding any qualifying conditions such as legal blindness.

- Indicate income sources and amounts. Make sure to include forms like W-2, 1099, and any other relevant income documentation.

- Complete sections related to deductions, including medical expenses, employee-related expenses, taxes paid, and contributions. Be thorough in detailing these items to maximize potential deductions.

- Fill out the self-employed business income and expenses section if applicable. Record your business name, address, federal ID, and various income and expense figures.

- Document any additional information relevant to your taxes, including anticipated changes for the next year, and prepare your questions for your tax professional.

- Once you have completed every section, review the information to ensure completeness and accuracy. Make any necessary edits before finalizing the form.

- Save your changes, and proceed to download or print the completed form as needed. You can also share the document with your tax preparer or relevant parties.

Start filling out the ORGANIZER & CHECKLIST FOR 201 TAXES online today to prepare for tax season.

An organizer specializes in cleaning and sorting out homes and spaces, using various organizational systems and strategies. They are primarily responsible for coordinating with clients and learning their preferences, traveling to different places, determining areas of improvement, and implementing corrective measures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.