Loading

Get T1 General Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T1 General Sample online

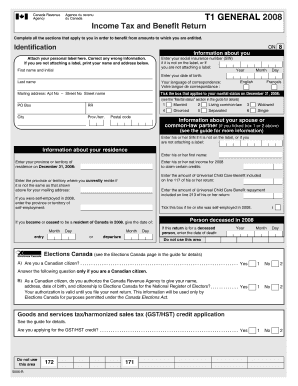

Completing the T1 General Sample online is an important step in managing your income tax and benefit return. This guide will provide you with a clear and structured approach to filling out the form, ensuring that you capture all necessary information accurately.

Follow the steps to complete your T1 General Sample online.

- Click the ‘Get Form’ button to access the T1 General Sample and open it in your preferred online editor.

- Begin with the identification section. Ensure to attach your personal label. If you don't have one, manually print your first name, last name, and address. Additionally, enter your social insurance number and date of birth.

- Indicate your marital status as of December 31, 2008, by ticking the appropriate box, ensuring that it corresponds to the relationship category that applies to you.

- If applicable, provide information about your spouse or common-law partner, including their social insurance number, first name, net income for 2008, and any Universal Child Care Benefit amounts from their return.

- Fill out your residence information, including your province or territory as of December 31, 2008. If you were self-employed during the year, indicate that status as well.

- Complete the total income section by entering all relevant income sources, including employment income, pension benefits, and any other applicable financial information.

- Proceed to calculate your net income by entering all deductions applicable to you, following the guidance in the form for specific line numbers.

- Continue to the taxable income section and compute your taxable income based on the provided inputs.

- Finally, review the refund or balance owing sections. Enter any necessary amounts and complete the direct deposit information if applicable.

- Once all fields are filled, save your changes, then download, print, or share your completed T1 General Sample as required.

Take action now and complete your T1 General Sample online for a smooth tax filing experience!

Creating a T1 General Sample starts with obtaining the proper form from the Canada Revenue Agency's website. After that, gather all financial documents, like your T4 slips and receipts. Fill in your income details and deductions to complete the form accurately for effective tax filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.