Loading

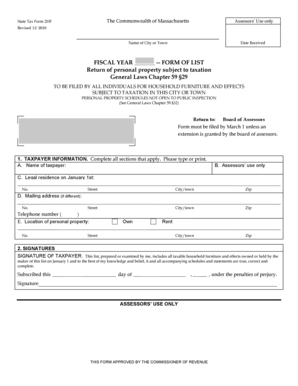

Get The Commonwealth Of Massachusetts Assessors Use Only Name Of City Or Town State Tax Form 2hf Date

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the The Commonwealth Of Massachusetts Assessors Use Only Name Of City Or Town State Tax Form 2HF Date online

Filling out the Commonwealth Of Massachusetts Assessors Use Only Name Of City Or Town State Tax Form 2HF Date is an essential part of reporting personal property for taxation. This guide will walk you through the process of completing this form online, ensuring you provide all necessary information accurately.

Follow the steps to successfully complete your tax form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the taxpayer information section. Complete all applicable fields. You will need to provide your name, legal residence as of January 1st, and, if applicable, a different mailing address. Be sure to include your telephone number.

- In the location of personal property section, indicate whether you own or rent the property where your household furnishings are located. Provide the full address.

- Next, proceed to the signatures section. Confirm that you have prepared or examined the list accurately and have included all taxable household furniture and effects. Sign and date the form.

- Review the general information that outlines who must file, the submission deadlines, penalty information, and potential audits. Ensure you understand your obligations under these guidelines.

- Fill out the schedules, listing all household items in the relevant categories such as appliances, tools, furniture, personal effects, unregistered vehicles, and any other taxable personal property. Complete as much detail as possible.

- Calculate and enter the estimated market values and purchase prices for each item in the corresponding schedule. Ensure the totals are correct.

- Once you have completed all sections, verify that all information is accurate and complete for submission. Save changes to your document.

- Finally, download, print, or share the completed form as required and submit it to the Board of Assessors by March 1, or within the extended time frame if applicable.

Start filing your form online now to stay compliant and avoid penalties.

The excise rate is $25 per $1,000 of your vehicle's value. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.