Get Ss 4 Form Example

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ss 4 Form Example online

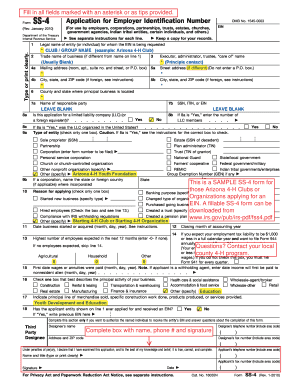

Filling out the Ss 4 Form Example is an essential step for individuals and organizations applying for an Employer Identification Number (EIN). This guide provides clear instructions to help you navigate each section of the form efficiently.

Follow the steps to complete the Ss 4 Form Example online.

- Press the ‘Get Form’ button to access the form in your browser.

- In line 1, enter the legal name of the entity or individual requesting the EIN. Ensure clarity and accuracy.

- In line 2, provide the trade name of the business if it differs from the legal name entered above.

- For line 3, input the name of the executor, administrator, or trustee, if applicable.

- Complete lines 5a and 5b with the street address, city, state, and ZIP code. Remember, do not use a P.O. box.

- Fill out line 4a with the mailing address if it is different from line 5a. Include room, apartment, or suite information, as needed.

- Indicate the county and state where the principal business is located in line 6.

- In line 7, provide the name of the responsible party.

- Input the SSN, ITIN, or EIN of the responsible party in line 7b.

- For line 8, answer whether the application is for a limited liability company (LLC) and proceed as indicated.

- In line 9, specify the type of entity by selecting the appropriate box.

- Indicate the reason for applying in line 10 by checking the appropriate box that applies.

- Complete line 11 with the date the business started or was acquired.

- If applicable, follow line 12 to indicate the closing month of the accounting year.

- In line 13, input the highest number of employees expected in the next 12 months, marking -0- if none.

- For line 18, state whether the applicant entity has previously applied for an EIN and provide the previous EIN if applicable.

- If desired, use the third-party designee section to authorize someone to receive the EIN and address questions.

- Finally, confirm your entries by signing and dating the application. Ensure that your contact details, including a phone number and fax number, are clearly noted.

Complete the Ss 4 Form Example online today for a smooth EIN application process.

To fill out line 4 on the Form W-4V, first, identify the amount you want withheld from your payments. You can select from options like a specific dollar amount or a percentage, depending on your tax situation. It's essential to ensure the amount aligns with your tax requirements to avoid any underpayment penalties. For further assistance with completing forms like the SS-4 Form example, consider using the resources available on the US Legal Forms platform for clarity and support.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.