Loading

Get Form 1745

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1745 online

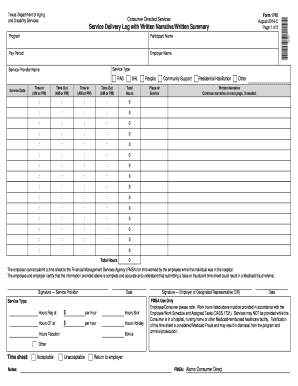

Filling out Form 1745 is an important step for individuals utilizing consumer directed services in Texas. This guide will walk you through the online process of completing the form, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to successfully complete Form 1745 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the participant's name in the designated field. Ensure that the name matches the documentation on file.

- Input the pay period for which you are documenting services. Be specific about the dates included in this timeframe.

- Fill in the employer name, which refers to the individual or entity that is responsible for the employment.

- Select the type of service being provided from the options listed, such as Personal Assistance Services (PAS) or Supported Home Living (SHL).

- Provide the name of the service provider delivering the care. This is essential for accurate record-keeping.

- For each service date, input the appropriate time in and out, ensuring that you denote AM or PM to avoid confusion.

- Calculate and enter the total hours worked for each service date, summing the hours accurately.

- If there are any respite services or other services provided, indicate them in the designated fields.

- Complete the written narrative section, providing any additional details necessary about the services delivered. Continue on the next page if more space is required.

- Certify the information by obtaining the appropriate signatures from the service provider and the employer or designated representative, ensuring the date is also included.

- Review all entries for accuracy before making any final submissions. Once confirmed, you may save changes, download, print, or share the form as needed.

Complete your Form 1745 online today to ensure timely service documentation and compliance.

When filing taxes in Missouri, you need your W-2 forms, 1099 documents, and proof of any tax credits or deductions you may qualify for. It is also beneficial to have Form 1745 ready, as it helps clarify your tax position. Additionally, keeping records of your income and expenses is essential. By organizing your documents, you can simplify the filing process and ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.