Loading

Get Canada Rc199 E 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC199 E online

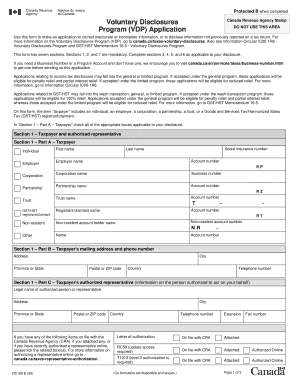

The Canada RC199 E form is essential for individuals and businesses looking to correct or disclose tax-related information to the Canada Revenue Agency. This guide provides straightforward, step-by-step instructions to assist users in completing the form online accurately.

Follow the steps to successfully complete the Canada RC199 E form.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Begin with Section 1, where you will need to identify the taxpayer. Complete Part A by checking all relevant boxes indicating whether you are an individual, employer, corporation, partnership, trust, or a GST/HST registrant/claimant. Fill in the required information, such as social insurance number, name, and relevant account numbers.

- Continue to Part B, where you provide the taxpayer's mailing address and phone number. Ensure all details, including country and postal code, are accurate.

- In Part C, if you have an authorized representative, input their legal name, address, and contact details. Mark any authorization documents you have on file with the Canada Revenue Agency.

- Move on to Section 2, where detailed descriptions of your circumstances and facts are required. Answer all questions regarding past due dates, penalties, and the completeness of your application.

- If applicable, proceed to Section 3 for GST/HST, Domestic, Foreign, and Non-Resident Information Returns. Tick boxes and provide pertinent details for the income or asset disclosures.

- Fill out Section 4 if your disclosure involves GST/HST non-compliance. Enter relevant reporting periods and amounts related to GST/HST claims.

- Complete Section 5 for domestic income disclosures if applicable. Provide income amounts, types of returns, and any relevant tax years.

- For foreign income disclosures, navigate to Section 6. Input details for each foreign income source, including years and reported income, and attach supporting documents as needed.

- Lastly, in Section 7, ensure the form is signed by the taxpayer. Review your declarations carefully, and provide the signature and date.

- After completing the form, save your changes, and optionally download, print, or share the completed document as necessary.

Complete your Canada RC199 E form online today to ensure accurate disclosures and corrections.

To file a nil payroll remittance online, log into your CRA My Business Account and select the appropriate remittance option. You will need to indicate that there are no payroll deductions for the period. Canada RC199 E will help you navigate this process efficiently, ensuring that your nil payroll remittance is completed correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.