Get 51781 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 51781 Form online

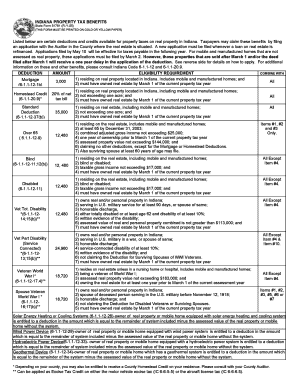

The 51781 Form is a crucial document for property tax benefits in Indiana. This guide will provide you with clear, step-by-step instructions on completing the form online, ensuring you understand each section and can successfully apply for available deductions and credits.

Follow the steps to complete the 51781 Form online effectively.

- Press the ‘Get Form’ button to access the 51781 Form and open it in the editor.

- Begin by entering your personal information in the designated fields, including your name, address, and contact details.

- Next, review the eligibility requirements for the deductions listed. Make sure to gather any necessary documentation you may need to support your claims.

- Fill in the specific deductions for which you are applying. Indicate your ownership status of the property and confirm you meet the deadlines for filing.

- If applicable, provide any additional required forms or proof that may verify your eligibility, such as tax bills or disability certifications.

- Review the completed form for accuracy. Make sure all fields are filled out correctly to avoid delays in processing.

- Finally, save your changes to the form. You can then choose to download, print, or share the completed document as needed.

Complete your 51781 Form online today for your property tax benefits.

Get form

The savings from homestead exemption in Georgia can vary based on property value and local tax rates. Typically, homeowners can save hundreds to thousands of dollars each year by filing the 51781 Form and qualifying for exemptions. These reductions in taxable value directly impact your overall property tax bill. Consulting with uslegalforms can help you calculate potential savings and navigate the application process effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.