Loading

Get Principal Bank Ira Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Principal Bank IRA Distribution Form online

Completing the Principal Bank IRA Distribution Form online can seem daunting, but with a systematic approach, it can be easy and straightforward. This guide will walk you through each section of the form to help ensure your distribution request is processed correctly.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

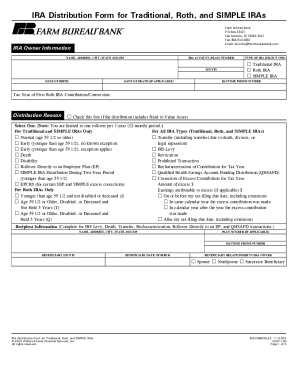

- Fill out the IRA owner information, including your name, address, Social Security Number, date of birth, and contact details. Make sure to select the type of IRA you hold: Traditional, Roth, or SIMPLE.

- Indicate the tax year of your first Roth IRA contribution or conversion if applicable, and provide the date of death if you are completing this form due to a beneficiary's distribution.

- Choose the distribution reason from the provided options. For Traditional and SIMPLE IRAs, select whether the distribution is normal or early. For Roth IRAs, indicate the relevant criteria for distribution.

- Complete the recipient information if the distribution is due to IRS levy, death, transfer, or other specified reasons. Make sure to provide accurate details of the recipient's name, address, and relationship to the IRA owner.

- Select the payment instructions. Choose between immediate or scheduled distributions and specify the amount requested, along with the desired payment method.

- Fill out the withholding election section if applicable. Generally, this does not apply to Roth IRAs, but you may need to specify your federal withholding rate using Form W-4R.

- Review the signatures section. Ensure that you or the authorized individual signs and dates the form for it to be legally binding.

- After completing the form, save your changes. You can then download or print the form for your records or to share it with relevant parties.

Start filling out your Principal Bank IRA Distribution Form online today to ensure a smooth distribution process.

Yes, you can withdraw the principal amount from your IRA, subject to the terms of your account. The Principal Bank IRA Distribution Form is necessary for this process. Keep in mind that withdrawals may have tax implications, so it's wise to assess your situation before proceeding. Consulting with a financial advisor can also provide personalized guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.