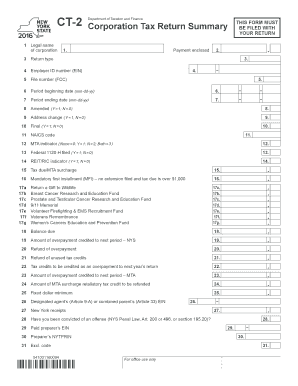

Get Ct 2 Corporation Tax Return Summary 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Ct 2 Corporation Tax Return Summary 2019 online

How to fill out and sign Ct 2 Corporation Tax Return Summary 2019 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The era of daunting intricate legal and tax documents has come to an end. With US Legal Forms, the entire process of completing formal documents is stress-free. A robust editor is right at your disposal, providing you with a range of helpful tools for filing a Ct 2 Corporation Tax Return Summary 2019. These suggestions, along with the editor, will assist you throughout the entire procedure.

There are numerous options for receiving the document: as an immediate download, as an email attachment, or through the mail as a physical copy. We expedite the process of completing any Ct 2 Corporation Tax Return Summary 2019. Utilize it now!

- Press the orange Get Form button to commence editing.

- Activate the Wizard mode on the upper toolbar to gain additional advice.

- Fill out each editable field.

- Ensure the information you include in the Ct 2 Corporation Tax Return Summary 2019 is current and precise.

- Insert the date into the template using the Date feature.

- Click the Sign button and create an electronic signature. You will have three options available: typing, drawing, or capturing one.

- Confirm that every field is accurately completed.

- Tap Done in the upper right corner to save and send or download the document.

How to modify Get Ct 2 Corporation Tax Return Summary 2019: personalize documents online

Streamline your document preparation process and tailor it to your requirements with just a few clicks. Complete and endorse Get Ct 2 Corporation Tax Return Summary 2019 using a powerful yet intuitive online editor.

Preparing documents is often challenging, particularly when you only handle it sporadically. It requires you to meticulously adhere to all protocols and accurately fill in all fields with complete and precise information. However, it frequently happens that you need to amend the document or incorporate additional sections to complete. If you wish to enhance Get Ct 2 Corporation Tax Return Summary 2019 before submission, the simplest method is to use our robust yet easy-to-navigate online editing tools.

This comprehensive PDF editing service allows you to swiftly and effortlessly finalize legal documents from any internet-enabled device, perform straightforward modifications to the form, and add extra fillable sections. The service allows you to select a specific area for each data type, such as Name, Signature, Currency, and SSN, among others. You can designate them as required or conditional and assign each field to a specific recipient.

Our editor is a flexible, multi-functional online solution that aids you in swiftly and seamlessly tailoring Get Ct 2 Corporation Tax Return Summary 2019 alongside other templates to meet your requirements. Reduce document preparation and submission time while ensuring your forms appear pristine without any hassle.

- Access the necessary file from the directory.

- Populate the fields with Text and drag Check and Cross tools to the checkboxes.

- Use the right-side panel to modify the template by adding new fillable sections.

- Select the areas based on the type of information you wish to gather.

- Set these fields as required, optional, or conditional, and arrange their order according to preference.

- Assign each section to a specific individual using the Add Signer feature.

- Confirm that all necessary changes have been made and click Done.

The mailing address for the CT-1120 depends on whether you are including a payment or filing without a payment. For payments, you generally send it to the Connecticut Department of Revenue Services. It is crucial to check the latest instructions on the Connecticut DRS website to ensure you send your form to the right place. Proper mailing helps in processing your Ct 2 Corporation Tax Return Summary 2019 efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.