Loading

Get P15 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P15 Form online

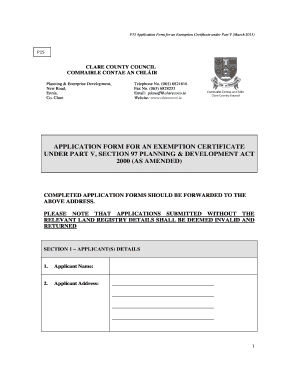

Completing the P15 Form online for an exemption certificate under the Planning and Development Act is a crucial step for applicants. This guide provides clear, step-by-step instructions to ensure you fill out the form accurately and efficiently.

Follow the steps to complete your P15 Form successfully.

- Press the ‘Get Form’ button to access the P15 Form and open it for editing.

- In Section 1, enter your details as the applicant. Include your full name, address, and contact information. If you have an agent representing you, provide their name and contact details as well.

- Fill out Section 2 with information about the proposed development site. Include the location, townland, and postal address, along with the number of dwelling units and site area.

- Proceed to Section 3, where you will detail land interests. Complete the tables regarding ownership and interests in the land, ensuring you provide accurate dates and information.

- In Section 4, you must affirm the accuracy of the information provided. This section will require your signature and date. Ensure you understand this declaration before signing.

- Lastly, review the application checklist attached to ensure all required documents are included. These typically involve copies of land registry entries and relevant maps.

- Once all sections are completed and verified, you can save your changes, download, print, or share the form as needed.

Complete your P15 Form online today to expedite your application process.

In British Columbia, the forms you need to file for probate typically include the P15 Form among others. You will also need to submit supporting documents such as a Death Certificate and a Will, if available. It’s advisable to consult the court’s guidelines or utilize USLegalForms for a comprehensive list and assistance in completing the required forms accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.