Loading

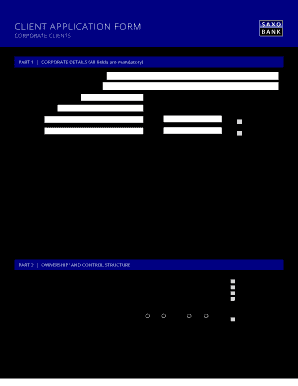

Get Dk Saxo Bank Client Application Form Corporate Clients 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DK Saxo Bank Client Application Form Corporate Clients online

Completing the DK Saxo Bank Client Application Form for Corporate Clients is a vital step in establishing your corporate account. This guide will provide you step-by-step instructions to ensure that you fill out the form accurately and effectively.

Follow the steps to complete the application form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in an appropriate editor.

- Part 1: Corporate Details. Fill out all mandatory fields regarding the corporate entity, including the registered name, registration number, website, incorporation date, email address, LEI, VAT status, NACE code, and TIN. Provide a brief business description detailing the nature of the business and its offerings.

- Continue with Part 2: Ownership and Control Structure. Input the details of all beneficial owners or individuals controlling the corporate entity, including their TIN, nationality, residential address, role, and any connections to politically exposed persons (PEP). Repeat this step for additional owners as necessary.

- In Part 3: Purpose and Scope of Client Relationship, select the purpose for applying for an account at Saxo Bank, indicate the intended investment over the next 12 months, and approximately state your level of investable assets. Specify the countries from which funds will be sent or received and choose the desired account currency.

- Complete Part 4: FATCA Status Declaration by selecting the applicable FATCA status for your entity. Ensure that all information is accurate and complete.

- Fill out Part 5: Claim for US Tax Treaty Benefits, if applicable. Indicate whether you wish to claim treaty benefits and provide the required declaration.

- In Part 6: CRS Information, declare your entity’s status in relation to the Common Reporting Standard. Include the country of tax residence and the TIN.

- Proceed to Part 7: Declaration of Bearer Shares. Confirm whether your company intends to issue bearer shares and understand the implications thereof.

- Review and understand the risks associated with trading as outlined in Part 8: Risk Disclosure. Ensure that you comprehend the characteristics and risks of complex products.

- In Part 9: Client Declaration, certify that all information provided is true and complete. Acknowledge your responsibility for notifying Saxo Bank of any changes.

- Finally, proceed to Part 10: Signature. Ensure that the appropriate individuals sign the form, print their names, and include the date.

- After completing the form, save the document. You may then download, print, or share it as needed. Ensure that all documents are sent to Saxo Bank’s designated contact.

Start completing your DK Saxo Bank Client Application Form online to establish your corporate account today.

The minimum deposit for opening an account with Saxo Bank generally varies depending on the account type you choose. Corporate clients typically face different requirements than individual clients, making it essential to check the specifics. To better understand these requirements, consider submitting the DK Saxo Bank Client Application Form for Corporate Clients.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.