Get Hiig Monoline Liquor Liability Application 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HIIG Monoline Liquor Liability Application online

The HIIG Monoline Liquor Liability Application is a crucial document for entities involved in the sale of alcohol. Filling out this application online can streamline the process and ensure accurate submission. This guide will lead you through each step to complete the application effectively.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to access the application and open it in your browser.

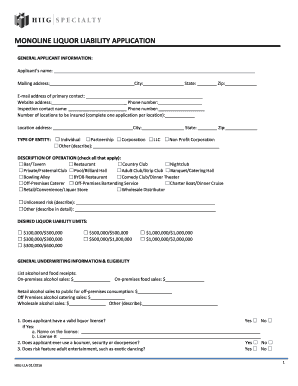

- Begin by entering the general applicant information. This includes the applicant’s name, mailing address, city, state, zip code, email address of the primary contact, website address, phone number, and the inspection contact name along with their phone number. Keep in mind that you must complete one application per location to be insured.

- Specify the type of entity applying for the liquor liability insurance by selecting the appropriate option from individual, partnership, corporation, LLC, non-profit corporation, or other.

- Provide a detailed description of your operation by checking all applicable boxes such as bar/tavern, restaurant, nightclub, and others. Include any additional descriptions required.

- Select your desired liquor liability coverage limits, which can vary from $100,000/$300,000 to $1,000,000/$2,000,000.

- Fill out the general underwriting information & eligibility section. This includes listing your alcohol and food receipts, verifying the presence of a valid liquor license, and answering specific questions regarding your operations, such as entertainment provided, hours of operation, and any previous violations.

- Complete any additional required sections based on your specific operations, including details for BYOB restaurants or other specialized operations.

- Ensure all information is accurate, and review the warranty statement at the end of the application, confirming the truthfulness of your submission.

- After filling out the form, save your changes. You should also download, print, or share the completed application as needed.

Get started with your application and complete it online today.

In California, businesses are required to carry certain types of insurance, including workers' compensation insurance if they have employees. Additionally, depending on the nature of your business, you may need to consider other forms of coverage, such as general liability insurance. The HIIG Monoline Liquor Liability Application can assist in identifying the specific insurance needs for your business in California.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.