Get Fidelity Investments Alternate Payee Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fidelity Investments Alternate Payee Distribution Form online

Completing the Fidelity Investments Alternate Payee Distribution Form online can be straightforward when you understand each section. This guide provides step-by-step instructions to help you accurately fill out the form, ensuring a smooth process for your distribution request.

Follow the steps to complete the form correctly.

- Press the ‘Get Form’ button to download the Alternate Payee Distribution Form and open it in the appropriate online editor.

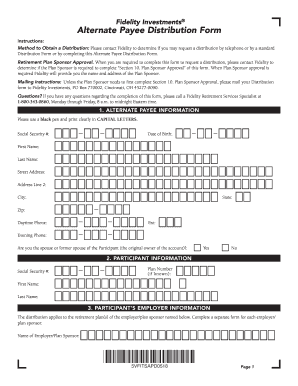

- Fill out the 'Alternate Payee Information' section. Use clear, capital letters to provide your Social Security number, date of birth, first name, last name, street address, city, state, and zip code. Additionally, include your daytime and evening phone numbers. Indicate your relationship with the participant by selecting 'Yes' or 'No' to the question regarding whether you are the spouse or former spouse.

- Proceed to the 'Participant Information' section. Input the participant's Social Security number and plan number if available. Provide their first and last name.

- In the 'Participant’s Employer Information' section, name the employer or plan sponsor associated with the retirement plan. If there are multiple employers, complete separate forms for each.

- Select the 'Reason for Distribution' from the relevant options. Keep in mind that you'll need to establish an Alternate Payee Account before any distribution can be processed.

- Choose your 'Distribution Options' carefully. Decide whether you want a full withdrawal, partial withdrawal, or choose other payment methods. Make sure to specify amounts and, if applicable, fund numbers. Note that only one option should be selected.

- Specify how you prefer to receive your payment in the 'Form of Payment' section. Options include a check, electronic funds transfer, or other specified methods. Ensure you follow any instructions for opening new accounts if necessary.

- Complete the 'Income Tax Withholding' section. Decide whether you want federal and state income taxes withheld and fill in the applicable percentages, if necessary.

- Sign the form in the 'Alternate Payee Signature' section. Certify that all the information you've provided is accurate. Add the date of signing.

- If required, the 'Plan Sponsor Approval' section must be completed. Follow up with Fidelity or the employer to check if this step is applicable to your distribution request.

- After completing all sections, review the form for accuracy. Users can save changes, then download, print, or share the completed form as needed.

Complete the Fidelity Investments Alternate Payee Distribution Form online to ensure an efficient processing of your distribution request.

To access Fidelity's Qualified Domestic Relations Order (QDRO), log into your account and look for the QDRO information under legal or account management sections. You may need to fill out specific forms, such as the Fidelity Investments Alternate Payee Distribution Form, to facilitate this process. If you require assistance, Fidelity’s support team can provide important guidance tailored to your situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.