Loading

Get Sd Form 21 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SD Form 21 online

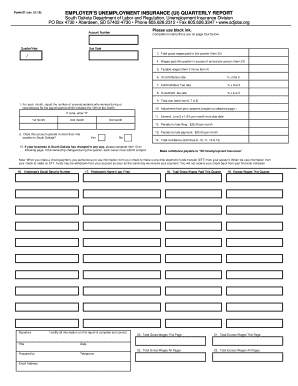

Filling out the SD Form 21 is an essential task for employers to report unemployment insurance data accurately. This guide will assist you in navigating each section of the form, ensuring that you provide the necessary information effectively and efficiently.

Follow the steps to complete the SD Form 21 online.

- Press the ‘Get Form’ button to retrieve the SD Form 21 and open it in your editor.

- Enter your account number in the designated field at the top of the form.

- Specify the quarter and year for which you are reporting unemployment insurance data.

- Fill out the total gross wages paid in the current quarter in Item 3.

- Provide the wages paid this quarter that exceed the annual taxable wage base in Item 4.

- Calculate taxable wages by subtracting Item 4 from Item 3 and enter the result in Item 5.

- Enter your current unemployment insurance contribution rate in Item 6, then calculate the tax due by multiplying it with the taxable wages from Item 5.

- Input the administrative fee rate in Item 7 and calculate the corresponding fee based on Item 5.

- Record the investment fee rate in Item 8 and determine the fee using Item 5.

- Sum the amounts from Items 6, 7, and 8 in Item 9 to find the total tax due.

- If applicable, explain any adjustments from prior quarters in Item 10.

- Enter interest and penalties due in Items 11, 12, and 13 if applicable.

- Complete Item 14 by calculating the total remittance, which is the sum of Items 9, 10, 11, 12, and 13.

- Make sure to sign the form in the designated area, providing the required name, title, date, and contact information.

- Review the form thoroughly for accuracy, then save your changes, download, print, or share the completed form as needed.

Complete your documents online today for a hassle-free filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In the context of South Dakota, an SD form generally refers to forms related to taxes and unemployment insurance. Specifically, the SD Form 21 helps in documenting employee wages and taxes owed. Understanding the requirements of this form is vital for any business operating in the state.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.