Loading

Get Au Macquarie Foreign Tax Status Declaration Form – Entities 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU Macquarie Foreign Tax Status Declaration Form – Entities online

This guide provides a comprehensive walkthrough for completing the AU Macquarie Foreign Tax Status Declaration Form for entities online. It is designed to help users effectively fill out the form, ensuring compliance with relevant tax requirements.

Follow the steps to complete your form accurately.

- Click ‘Get Form’ button to access the AU Macquarie Foreign Tax Status Declaration Form and open it for editing.

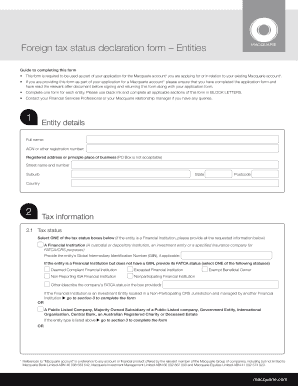

- Begin by filling out the entity details section. Include the full name of the entity, the Australian Company Number (ACN) or other registration number, and the registered address or principal place of business. Remember to avoid using a PO Box and write in BLOCK LETTERS.

- Move to the tax information section. You will select one of the tax status options provided. If your entity is a financial institution, ensure to provide the Global Intermediary Identification Number (GIIN) if applicable, along with other relevant FATCA status information.

- If applicable, complete the foreign controlling persons section. Indicate if any beneficial owners or controlling persons are tax residents of countries other than Australia. Provide details for each individual as required.

- Continue to the country of tax residency section. If the entity is a tax resident of another country, list the country and the corresponding tax identification number (TIN). If there is no TIN, select one of the reasons provided for not having one.

- Proceed to the declaration section. This must be signed by the appropriate representative of the entity, ensuring that all signatures are collected as required, depending on the type of entity (individual, company, partnership, etc.).

- Once completed, carefully review the form for accuracy. Save your changes, and you may then download, print, or share the completed document as necessary.

Complete your AU Macquarie Foreign Tax Status Declaration Form online today for a smooth application process.

For at call accounts, you need to provide a TFN, ABN or an exemption status prior to the first interest payment posting to the account. Withholding tax applies to investment accounts that earn more than $120 interest per annum.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.