Loading

Get Massmutual Direct Rollover Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MassMutual Direct Rollover Form online

Filling out the MassMutual Direct Rollover Form online can be a straightforward process when approached step by step. This guide will help you navigate through each section of the form with clarity and confidence.

Follow the steps to successfully complete the form.

- Press the 'Get Form' button to access the MassMutual Direct Rollover Form and view it in your online editor.

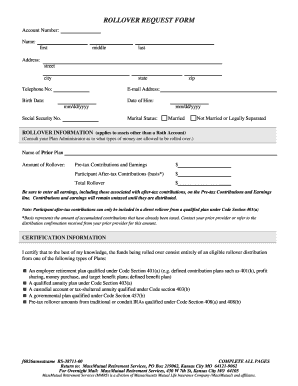

- Input your personal information in the designated fields, including your name (first, middle, last), address (street, city, state, zip), telephone number, email address, birth date, date of hire, and social security number.

- Select your marital status by checking the appropriate box (Married or Not Married/Legally Separated).

- In the Rollover Information section, specify the name of your prior plan and enter the amount for pre-tax contributions and earnings, participant after-tax contributions, and total rollover. Make sure to clarify that all earnings, including those on after-tax contributions, are recorded in the pre-tax contributions field.

- Complete the Certification Information section by affirming that the funds consist entirely of eligible rollover distributions from the provided plan types.

- Sign and date the certification at the bottom of the form, indicating your understanding and approval of the information provided.

- If applicable, have the Plan Administrator or IRA Trustee complete their certification section to confirm the rollover eligibility. They must provide their signature, type their name, and include their contact information.

- Choose your investment selection by checking the appropriate box based on your participation status and enter the percentages for the rollover contribution in the designated fields. Ensure that the total percentages equal 100%.

- Finally, review all the sections for accuracy, save your changes, and you may then download, print, or share your completed form as necessary.

Complete your MassMutual Direct Rollover Form online today for a seamless rollover experience.

The primary difference lies in how funds are transferred. A direct rollover involves moving your funds straight from one retirement account to another without you receiving them, while a standard rollover requires you to take possession of your funds. Using the MassMutual Direct Rollover Form simplifies the process and helps avoid potential tax implications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.