Get Caliber Home Loans Loss Mitigation Application 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Caliber Home Loans Loss Mitigation Application online

Completing the Caliber Home Loans Loss Mitigation Application online can provide essential assistance to those facing financial challenges. This guide offers a clear, step-by-step approach to help users navigate the application process with ease and confidence.

Follow the steps to successfully complete your application.

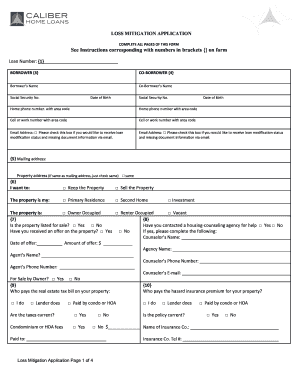

- Click ‘Get Form’ button to access the Loss Mitigation Application and open it in the online editor.

- Begin by entering your loan number as shown on your mortgage statement in the designated field.

- Fill in the borrower section, including the name and Social Security number of the primary borrower, alongside their date of birth.

- If applicable, complete the co-borrower section with their name, Social Security number, and date of birth following the same format.

- Provide contact details, including home and cell or work phone numbers, as well as an email address. Check the box if you wish to receive updates via email.

- Indicate your mailing address. If it is the same as the property address, simply check the box stating 'same.'

- Select your preference regarding the property: whether you wish to keep or sell it. Additionally, identify the type of property, such as primary residence, second home, or investment.

- Indicate if the property is currently listed for sale and whether you have contacted a housing counseling agency for assistance.

- Complete the section about the insurance premium and property taxes, specifying who is responsible for payment and whether they are current.

- If you have filed for bankruptcy, provide the relevant details, including the filing date and case number, if applicable.

- List any additional liens or mortgages on the property in the space provided, including the lien holder's name and balance.

- In the hardship affidavit section, select all applicable financial difficulties you are experiencing.

- Provide the number of people in your household that contribute to the income and fill out the income and asset details as outlined in the form.

- Review the acknowledgment and agreement carefully. After ensuring that all information is accurate and complete, proceed to sign the document.

- Once everything is filled out, save your changes. You can then download, print, or share the form as necessary.

Complete your Caliber Home Loans Loss Mitigation Application online today.

When a situation is referred to as 'loss mitigated,' it indicates that specific measures have been put in place to prevent or reduce financial loss, particularly concerning your mortgage. For Caliber Home Loans, this means exploring alternatives within their loss mitigation programs that can help you maintain your home. By taking action early, such as submitting a Caliber Home Loans Loss Mitigation Application, you can effectively mitigate potential losses.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.