Get Nj Cba-1 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ CBA-1 online

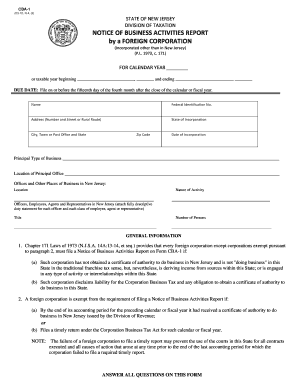

The NJ CBA-1 form, known as the Notice of Business Activities Report by a Foreign Corporation, is essential for foreign corporations conducting activities in New Jersey. This guide provides detailed, step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to complete the NJ CBA-1 form online effectively.

- Click ‘Get Form’ button to obtain the NJ CBA-1 form and open it in your online editor.

- Fill in the calendar year or the taxable year, including the start and end dates for the period you are reporting.

- Provide the corporate name and federal identification number in the designated fields.

- Enter the address of the corporation, including the street number, city, state, and zip code.

- Specify the state in which the corporation was incorporated and the date of incorporation.

- Indicate the principal type of business being conducted by the corporation.

- List all offices and other places of business located in New Jersey, along with the nature of activities being conducted at those locations.

- Complete the section detailing the officers, employees, agents, and representatives in New Jersey. Attach a descriptive duty statement for each.

- Answer all questions regarding the corporation's activities in New Jersey. Mark 'YES' or 'NO' as appropriate and provide additional details where required.

- Ensure that you complete the certification section by having an authorized officer of the corporation sign and date the form.

- Review the form for completeness and accuracy before submitting. Ensure all required attachments are included.

- After completing the form and ensuring it is accurate, you can save changes, download, print, or share the form as needed.

Complete the NJ CBA-1 form online now to ensure compliance with New Jersey regulations.

NJ CBT stands for New Jersey Computerized Based Testing, an innovative assessment format that uses technology for student evaluations. This system enables more efficient testing, providing quicker feedback and data analysis. Understanding NJ CBT is essential for anyone involved in the education system. The USLegalForms platform offers resources that can help navigate these assessments effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.