Loading

Get Peraa Guidelines

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Peraa Guidelines online

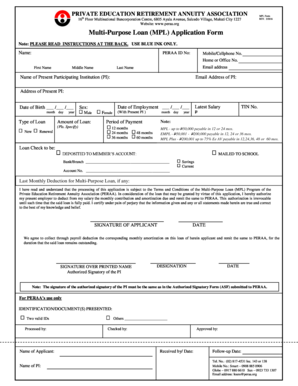

This guide provides a clear, step-by-step approach to completing the Peraa Guidelines for the Multi-Purpose Loan Application. Whether you are a first-time user or familiar with the process, this comprehensive instruction aims to assist you in submitting your application confidently and accurately.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to access the Multi-Purpose Loan Application Form. This will allow you to open the document in a suitable editor for completion.

- Begin filling out your personal information. Start with your name, including your first name, middle name, and last name. Provide your PERAA ID number, your mobile or cellphone number, and your home or office phone number.

- Next, indicate the name of your present participating institution as well as its email address and address.

- Fill out your date of birth in the specified format: month, day, and year. Select your sex (male or female) and indicate the type of loan you are applying for — either new or renewal.

- Specify the amount of the loan you are requesting and your latest salary information from your present participating institution.

- Choose your preferred period for repayment: 12 months, 24 months, 36 months, 48 months, or 60 months, based on the amount of the loan.

- Indicate how you would like the loan check to be handled: deposited to your account or mailed to your school. Provide the bank name and branch, as well as your account number if applicable.

- Read the terms and conditions carefully. Confirm that you understand the process and authorize your employer to deduct the necessary payments from your salary.

- Sign and date the application at the designated area to validate your submission. Ensure that the signature matches the one used on any submitted identification documents.

- Once completed, submit the form along with the required documents, including photocopies of two valid IDs with your signature.

- Finally, save changes, download or print the form, or share it as needed to ensure that all processes are completed seamlessly.

Take the next step towards securing your loan by completing the application online today!

Semi-retirement offers a blend of work and leisure, allowing individuals to ease into retirement while still receiving an income. This approach can enhance mental wellness and provide greater financial stability. The Peraa Guidelines support this lifestyle by helping you manage your finances effectively during this transitional phase.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.