Loading

Get Cpa Form 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cpa Form 2 online

Filling out the Cpa Form 2 online can be a straightforward process when you know what to do. This guide provides detailed instructions to help you complete each section accurately and efficiently.

Follow the steps to complete your Cpa Form 2 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This action allows you to access the necessary document required for your application.

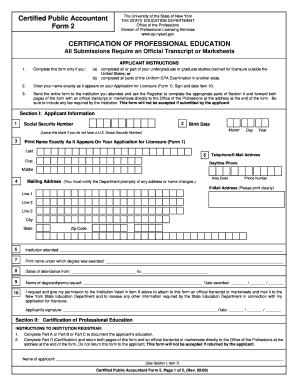

- In Section I, begin by entering your social security number and birth date. If you do not have a U.S. social security number, leave that field blank.

- Print your name exactly as it appears on your Application for Licensure (Form 1). This ensures consistency in your application.

- Provide your daytime phone number and e-mail address. Ensure that these are current, as they may be used for communication regarding your application.

- Fill out your mailing address, applying prompt notifications of any changes in your details.

- List the institution you attended, the name under which your degree was awarded, and your dates of attendance.

- Indicate the name of the degree or diploma issued and the date it was awarded.

- In the signature and date field, sign and date the form, authorizing your institution to send your transcripts directly to the relevant department.

- In Section II, leave the fields blank for the registrar to fill out. This section documents your education and the registrar must certify it.

- Ensure the registrar completes the appropriate part, either Part A, Part B, or Part C, depending on where you studied.

- Once your institution has completed this section, they will send it along with your official transcript or marksheets directly to the Office of the Professions.

- After completing the form, you can save your changes, download a copy for your records, print it out, or share the form as instructed.

Start filling out your Cpa Form 2 online today to ensure you meet the requirements for licensure.

Getting into the CPA profession typically begins with obtaining a degree in accounting or a related field. Once your educational path is clear, review the CPA Form 2 requirements to understand what you must accomplish. Enroll in a study program or join study groups for exam preparation, and seek internship opportunities to gain valuable experience before applying for your CPA license.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.