Loading

Get Form 8974

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8974 online

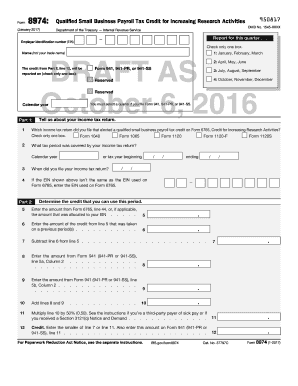

Filling out the Form 8974, which reports the qualified small business payroll tax credit for increasing research activities, can be straightforward with the right guidance. This guide will provide clear, step-by-step instructions to help you complete the form efficiently and accurately online.

Follow the steps to fill out the Form 8974 correctly online:

- Click the ‘Get Form’ button to access the form and open it for editing.

- Enter your employer identification number (EIN) at the top of the form.

- Select the quarter for which you are reporting. Choose one of the following options: January, February, March; April, May, June; July, August, September; or October, November, December.

- Indicate which income tax return you filed that elected a qualified small business payroll tax credit on Form 6765 by checking one of the provided options.

- Fill in the tax period covered by your income tax return, specifying the beginning and ending dates.

- If the EIN displayed does not match the EIN listed on Form 6765, provide the EIN used on Form 6765.

- In Part 2, enter the credit amount from line 44 of Form 6765 or the allocated amount relating to your EIN.

- Next, report the amount of credit that was taken on previous periods.

- Subtract the amount on line 6 from line 5 to determine the difference.

- Complete lines 8 through 12 according to the instructions, ensuring all additions and multiplications are correct and match the required calculations.

- Once you have completed the form, review all entries for accuracy.

- Finally, you can save changes, download, print, or share the completed form as needed.

Take action now and complete your Form 8974 online for efficient management of your tax credits.

Federal form 6765 is a tax credit for increasing research and Federal form 8974 is a specific small business tax credit for increasing research.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.