Loading

Get West Virginia Form Cst 286

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the West Virginia Form Cst 286 online

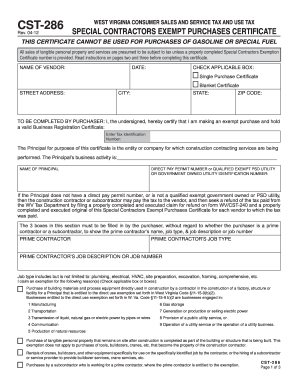

The West Virginia Form Cst 286 is a vital document for claiming exemptions on purchases made for construction activities. This guide provides a simplified method for filling out the form online, ensuring that all necessary information is accurately captured to facilitate your tax-exempt purchases.

Follow the steps to successfully complete the West Virginia Form Cst 286 online

- Click ‘Get Form’ button to access the Special Contractors Exempt Purchases Certificate and open it for editing.

- Begin by entering the name of the vendor from whom the purchase is being made. Ensure that this field is filled in completely.

- Enter the date of the transaction in the designated area provided on the form.

- Select the applicable box for either a single purchase certificate or a blanket certificate, based on your purchase needs.

- Complete the vendor's street address, city, state, and zip code to provide accurate contact information.

- In the section designated for the purchaser, declare your status by signing and certifying that you are making an exempt purchase. Include your valid Business Registration Certificate number.

- Fill in the name of the principal, which is the entity for whom the construction services are being performed. This is a critical part of the form.

- If applicable, insert the Direct Pay Permit Number or Identification Number for qualified exempt utilities. This details operational specifics for your exemption.

- Complete fields related to the prime contractor, including the prime contractor’s name, job type, and job description or job number. Use the suggested job types provided for clarity.

- Select the appropriate exemption reasons by checking the relevant boxes that apply to your situation, ensuring compliance with state tax regulations.

- Sign and date the certificate at the bottom, confirming all provided information is accurate and complete.

- Finally, after reviewing all entries for completeness and accuracy, you can save your changes, download the form, print it, or share it as necessary.

Complete your online forms efficiently and confidently today.

In West Virginia, most tangible personal property and certain services are taxable. This includes retail sales, leases, and rentals, although some exemptions apply. It's essential to consult resources or utilize the West Virginia Form Cst 286 to ensure that you are compliant with tax laws and regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.