Get Fnma Form 1081

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fnma Form 1081 online

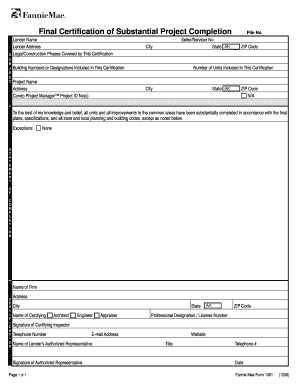

Filling out the Fnma Form 1081 online is a straightforward process that ensures you provide all necessary information for the final certification of substantial project completion. This guide will walk you through each step, so you can complete the form accurately and efficiently.

Follow the steps to complete the Fnma Form 1081 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Begin by entering the lender's name and address at the top of the form. Ensure that this information is accurate and up-to-date.

- In the section labeled 'Legal/Construction Phases Covered by This Certification', specify the phases relevant to the certification.

- Input your Seller/Servicer number and the state, city, and ZIP code associated with the project.

- Provide the project name, address, and Condo Project Manager™ Project ID numbers if applicable.

- Include the number of units that are part of this certification in the designated field.

- In the statement section, confirm that all units and improvements to the common areas are substantially complete, as per the final plans and relevant codes. If there are any exceptions, note them clearly.

- Complete the Statement of Completion by entering the name of the firm, address, and name of the certifying inspector, architect, or appraiser, along with their respective license number.

- Sign the certification by the certifying inspector and include their telephone number and email address.

- The final step requires the name and signature of the lender's authorized representative, along with their contact information and the date.

- Once you have completed all sections of the form, make sure to save your changes. You can also download, print, or share the form as needed.

Complete your documents online today for a seamless experience.

The most commonly used Fannie Mae appraisal form is the 1004, designed for single-family home assessments. This form provides lenders with critical information regarding a property’s value and condition. When completing this form, it is beneficial to be familiar with related documentation such as the Fnma Form 1081. For any assistance with these forms, uslegalforms can help simplify your appraisal needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.