Loading

Get Sd Eform 0990 V1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sd Eform 0990 V1 online

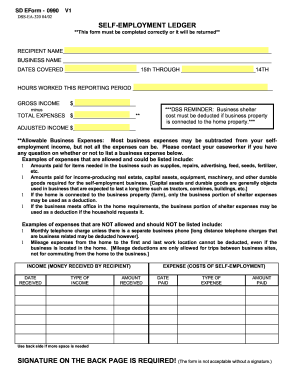

This guide provides clear steps for completing the Sd Eform 0990 V1 online. Follow these instructions to ensure that your self-employment ledger is filled out accurately and efficiently.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the Sd Eform 0990 V1 and open it for editing.

- Fill in the recipient's name in the designated field to identify the primary user of the form.

- Enter the business name in the corresponding section to indicate the name of the self-employment entity.

- Specify the dates covered by your report from the 15th through the 14th of the following month.

- Document the hours worked during the reporting period in the provided section.

- Input your gross income in the appropriate field.

- Deduct total expenses from your gross income and enter the resulting adjusted income.

- List any allowable business expenses, ensuring to consult with your caseworker if unsure about any deductions.

- Complete the income section by detailing each type of income received, along with the dates and amounts.

- Fill out the expenses section by recording each type of expense paid, along with the dates and amounts.

- If additional space is needed, use the back side of the form for extra details.

- Sign the back page of the form to validate your entries; the form will not be accepted without your signature.

- Once all fields are accurately filled, save your changes, and you may then download, print, or share the completed form.

Begin completing your documents online today!

How to use a manual self-employment ledger Open a spreadsheet or download a self-employment ledger template. Create a column for Income (money you've received) and Expenses (cost of running your business) Under Income add three columns: Date, Invoice, and Service/Product.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.