Loading

Get 1003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1003 online

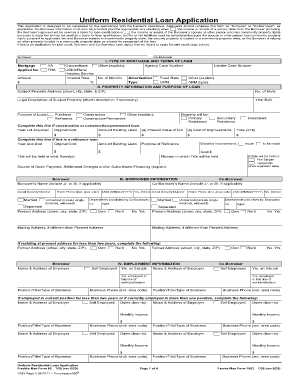

The 1003, also known as the Uniform Residential Loan Application, is a crucial document for individuals seeking a mortgage. This guide provides step-by-step instructions to help applicants accurately complete the form online, ensuring a smooth application process with clear guidance.

Follow the steps to successfully fill out the 1003 online.

- Press the ‘Get Form’ button to access the application and open it in your online editor.

- Begin by filling in your personal information as the Borrower, including name, social security number, marital status, and current address.

- If applicable, provide Co-Borrower information by entering their name, social security number, and other required details. Ensure to check the box indicating the inclusion of Co-Borrower income or assets.

- Proceed to the mortgage type section, selecting the desired loan type, such as VA, FHA, Conventional, or USDA/Rural Housing Service.

- In the property information section, enter the property address, number of units, and year built, along with the purpose of the loan—whether for purchase, refinance, or construction.

- Fill out the borrower and co-borrower employment information, including the name and address of your employer, years in the job, and monthly income details.

- Complete the combined housing expense information by detailing your monthly income and existing housing expenses, including first mortgage payments and associated costs.

- Document your assets and liabilities comprehensively, listing current accounts, outstanding debts, and any additional assets.

- Review the details of your transaction, including estimated costs, and answer all declarations truthfully.

- Finalize the application by signing electronically. Once completed, you can save changes, download a copy for your records, or share it with your lender.

Complete your 1003 online application today to streamline your mortgage process.

To print a 1003 in Arrive, first ensure that you have completed the application within the platform. Once your information is finalized, navigate to the printing options. You can find the option for printing the 1003 form conveniently on the dashboard. Printing the 1003 from Arrive ensures you have an accurate and professional document for your records or to share with your lender.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.