Loading

Get 2014 Fillable 1116 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Fillable 1116 Form online

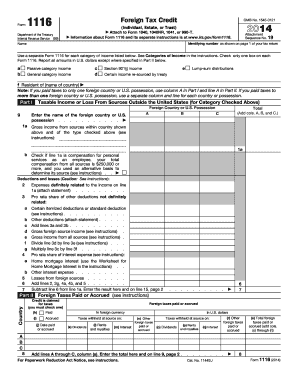

The 2014 Fillable 1116 Form is essential for individuals, estates, or trusts claiming a foreign tax credit. This guide will provide clear instructions for completing the form online, ensuring you can manage your tax obligations effectively.

Follow the steps to successfully complete the 2014 Fillable 1116 Form online.

- To begin, use the ‘Get Form’ button to download and open the form in an online editor.

- Identify your tax return form type and provide your identifying number on the first line.

- Enter your name in the designated field to identify who is filing the form.

- Select the category of income for which you are claiming the credit by checking the appropriate box (passive category, general category, etc.).

- In Part I, input your taxable income or loss from foreign sources corresponding to the checked category. Make sure to enter the foreign country or U.S. possession name.

- Record the gross income amounts and check the appropriate boxes for specific conditions related to your income.

- List any deductions related to the income and provide statements where required.

- Proceed to Part II to record the foreign taxes you paid or accrued; ensure you specify the type of taxation (paid or accrued) and include the corresponding amounts in currency.

- Calculate your total foreign taxes paid or accrued and enter this amount in the appropriate section.

- Move to Part III and begin figuring the credit by completing the necessary calculations from the previous steps and detailed previous line items.

- Finally, review all entered data for accuracy. Save changes, then download, print, or share the completed form as required.

Start filling out your 2014 Fillable 1116 Form online today!

Related links form

Yes, TurboTax offers the 2014 Fillable 1116 Form as part of its tax preparation software. This makes it easier for users to navigate filling out the form accurately. TurboTax provides guided assistance to help you input the necessary information about your foreign taxes. This streamlines the process, ensuring you can take advantage of any credits available to you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.