Loading

Get T1032

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T1032 online

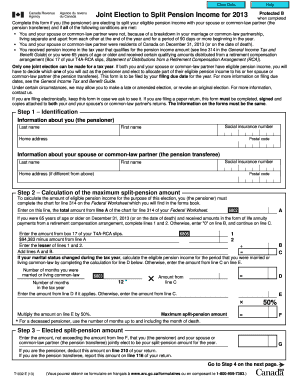

The T1032 form, known as the joint election to split pension income, allows pensioners to allocate part of their eligible pension income to their spouse or common-law partner. This guide provides clear, step-by-step instructions to assist users in completing the form online efficiently.

Follow the steps to accurately complete the T1032 online.

- Press the ‘Get Form’ button to access the T1032 form and open it for editing.

- Provide identification information. Enter your social insurance number, first name, last name, home address, and postal code in the relevant fields. Repeat this for your spouse or common-law partner, if their address differs.

- Calculate the maximum split-pension amount. Complete the chart for line 314 as outlined in the Federal Worksheet and enter the total from line A.

- Determine your elected split-pension amount. Enter an amount not exceeding line F that you and your spouse or common-law partner jointly elect for the year.

- Calculate the income tax deducted from your pension income. Enter the total tax deducted that’s relevant to the elected split-pension amount.

- Complete the joint certification. Both the pensioner and the spouse or common-law partner must sign and date the form to confirm the election.

Complete your T1032 online today to optimize your tax benefits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing partnership income typically involves reporting the income directly on the partners' individual tax returns. Each partner must accurately declare their share of the partnership profits on their forms, including the T1032 if applicable. This ensures each partner is taxed appropriately, reflecting their portion of the business's earnings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.