Loading

Get 4506 T Form Printable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4506 T Form Printable online

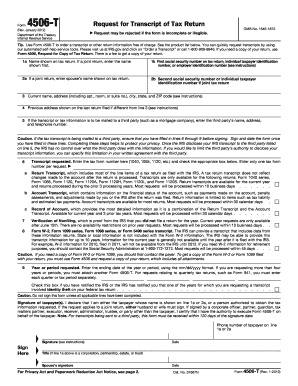

Filling out the 4506 T Form Printable is essential for requesting a transcript of your tax return. This guide will provide you with a clear and straightforward approach to completing the form effectively.

Follow the steps to fill out the 4506 T Form Printable online

- Click ‘Get Form’ button to obtain the form and open it in the editor for filling out.

- In line 1a, enter the name as shown on your tax return. If it is a joint return, include the name that appears first.

- On line 1b, provide the first Social Security number, Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN) displayed on the tax return.

- If applicable, fill in line 2a with your spouse’s name as shown on the tax return for a joint return. Enter the second Social Security number or ITIN in line 2b.

- In line 3, specify your current address, including any apartment, room, or suite number. Ensure accuracy for correspondence.

- For line 4, input the previous address as shown on your last return filed if it differs from line 3.

- If the transcript is to be sent to a third party, enter their name, address, and telephone number in line 5.

- Indicate the type of transcript you require on line 6 by entering the tax form number (1040, 1065, etc.) and checking the appropriate box.

- Complete line 9 with the ending date of the tax year or period you are requesting, using the mm/dd/yyyy format.

- Sign and date the form as a declaration that you are either the taxpayer or an authorized individual. Ensure all applicable lines are filled before signing.

- After completing the form, you can save changes, download it, print, or share as necessary.

Complete your documents online confidently and ensure all information is accurate!

To receive a non-filing verification form from the IRS, you should complete Form 4506-T. This form will allow you to request verification for the years you did not file taxes. You can download the 4506 T Form Printable online, fill it out, and submit it via mail or fax. By using USLegalForms, you can simplify the process and gain access to necessary forms and guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.