Loading

Get Va Interest Rate And Discount Disclosure

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Va Interest Rate And Discount Disclosure online

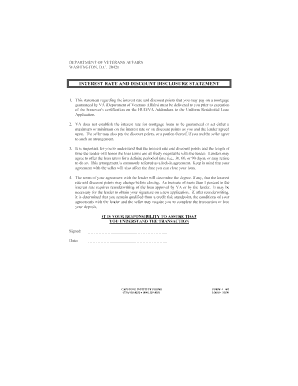

Completing the Va Interest Rate And Discount Disclosure form is a crucial step for anyone involved in a loan process. This guide provides clear, step-by-step instructions to help users navigate the form with confidence.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your personal information in the designated fields. This typically includes your name, address, and contact details. Ensure all information is accurate, as it will be used for communication regarding your loan.

- In the interest rate section, specify the terms of the loan's interest rate. Enter both the fixed and variable rates if applicable. Take the time to review the interest rates provided by your lender to ensure accuracy.

- Fill in the discount information section, if applicable. This part may require you to indicate any points available for the loan. Ensure you understand the implications of any discount points on your overall loan costs.

- After completing all necessary fields, take a moment to review the information entered for any errors or omissions. It is essential to present accurate and complete information.

- Finally, save your changes. Once you have ensured that all information is correct, you may download, print, or share the completed form according to your needs.

Take the next step in your loan process by completing your Va Interest Rate And Discount Disclosure online today.

The VA interest rate assumption allows a buyer to take over the seller’s existing VA mortgage at its current interest rate. This can be advantageous for buyers if the existing rate is lower than current market rates. The VA Interest Rate and Discount Disclosure outlines how this process works, ensuring all parties are informed about the implications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.