Loading

Get Bb&t Address On 1099r Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bb&t address on 1099r form online

Filling out the Bb&t address on the 1099r form online can be straightforward with the right guidance. This comprehensive guide will provide you with clear, step-by-step instructions to ensure your form is completed accurately and efficiently.

Follow the steps to successfully complete the Bb&t address on your 1099r form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

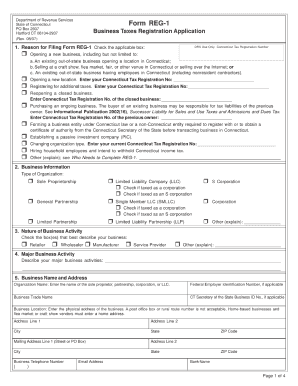

- Review the form layout to familiarize yourself with its components. Look for sections indicating where personal information is to be filled out, including the recipient's name and address details.

- Locate the section specifically designed for the Bb&t address. This might be labeled under your financial institution or service provider's information.

- Enter the complete Bb&t address, ensuring to include the street address, city, state, and ZIP code accurately to prevent any mailing issues.

- Continue filling out any other required fields, such as your identification number, beneficiary details, and any relevant financial information.

- Once all sections are filled out correctly, review the entire form to ensure there are no errors or omissions.

- Finally, save your changes, and choose to either download, print, or share the completed form as needed.

Ready to fill out your documents online? Start by accessing the form and follow the steps above.

Distribution code T on a 1099-R signifies a transition to a Roth IRA conversion. This means that the distribution is subject to specific tax rules, which can complicate your tax situation. Make sure to consider how this relates to the Bb&t Address On 1099r Form, as it could influence your overall tax strategy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.