Get 5498 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5498 Form online

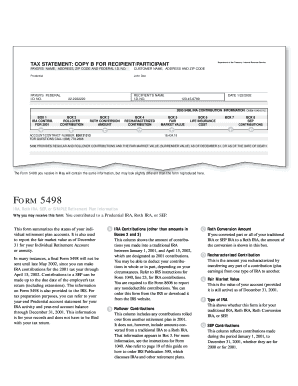

Filling out the 5498 Form online is an essential step for reporting contributions to your Individual Retirement Account (IRA) and for tracking your retirement savings. This guide will provide you with a comprehensive overview of how to complete the form efficiently and accurately.

Follow the steps to complete your 5498 Form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor of choice.

- In the first section, input the payer’s name, address, and federal identification number accurately. This information is crucial as it identifies the organization managing your IRA.

- Next, fill in your name, address, and identification number in the recipient’s section. Ensure that all information matches official records to avoid complications.

- Proceed to Box 1, where you will report the IRA contributions made for the tax year 2001, including any contributions made up until April 15, 2002. This amount may be partially deductible depending on your circumstances.

- In Box 2, indicate any rollover contributions from other retirement plans made during the year 2001. Ensure that you do not confuse this with Roth conversion amounts.

- If applicable, fill in Box 3 with the total amount of any Roth conversion you executed, showing the amount converted from a traditional IRA to a Roth IRA.

- In Box 4, report any recharacterized contributions, which involve moving funds from one type of IRA to another.

- Next, fill in Box 5 with the fair market value of your account as of December 31, 2001. This value reflects the account's worth.

- Box 6 and Box 7 pertain to life insurance cost and other relevant details; fill these sections as required or applicable to your situation.

- Lastly, review all the filled sections for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as needed.

Take the next step towards managing your retirement savings by completing your 5498 Form online today.

The 5498 Form is essential for reporting contributions made to individual retirement accounts (IRAs). It provides details such as the amount contributed, the type of account, and any conversions from other retirement accounts. This information helps both you and the IRS verify that you are meeting contribution limits. Understanding the 5498 Form can help you optimize your retirement savings strategy.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.