Loading

Get Mass Mutual Rmd Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mass Mutual Rmd Request Form online

Filling out the Mass Mutual Rmd Request Form online can seem daunting, but this guide will help you navigate each section with clarity. By following the outlined steps, you can ensure that your minimum distribution request is completed accurately and efficiently.

Follow the steps to complete the Mass Mutual Rmd Request Form.

- Press the ‘Get Form’ button to access the Mass Mutual Rmd Request Form and open it in your editing platform.

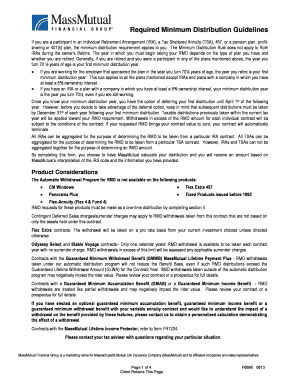

- In the Owner/Participant Information section, input your contract or certificate number, your name, daytime phone number, and email address. Make sure this information is accurate to avoid any processing delays.

- Proceed to the Required Minimum Distribution Calculation section. Indicate if your account was with MassMutual as of December 31 of the previous year by selecting 'Yes' or 'No.' If 'No,' provide the Fair Market Value of the prior year.

- In the Automatic Required Minimum Distribution (RMD) section, choose your desired frequency for withdrawals (monthly, quarterly, semi-annually, annually) and specify a start date for these automatic distributions.

- If you prefer a one-time distribution, complete the One-Time RMD Distribution section. Specify if the distribution is for the current year or provide details for a previous year.

- Under Distribution Instructions, complete whether proceeds will go to an alternate payee, and if opting for electronic funds transfer, enter your bank account details.

- Review the Withholding Information section and make your withholding election regarding federal income tax, selecting whether to withhold or not and specifying the percentage if applicable.

- If necessary, complete the Spousal Consent section, ensuring that spousal consent is obtained when applicable.

- Sign and date the form in the Signatures section. Ensure all other required signatories, including your spouse and notary if applicable, complete their portions.

- Finally, review all entered information for accuracy. You can then save the form, download it, print it, or share it as needed.

Complete your Mass Mutual Rmd Request Form online today for a smooth and efficient experience.

For your RMD processing, the Mass Mutual Rmd Request Form is essential to initiate your distribution. This form allows you to specify the amount and timing of your RMD. Additionally, remember that IRS Form 5329 may come into play if you encounter issues or missed distributions. Consider using uslegalforms to simplify gathering and completing these necessary documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.