Loading

Get Co-applicant Information If Applicable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

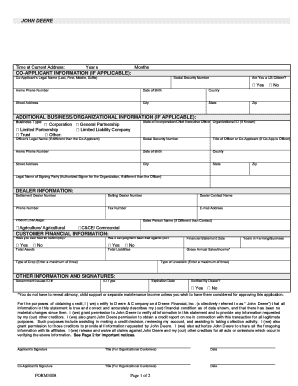

How to fill out the CO-APPLICANT INFORMATION if applicable online

Filling out the CO-APPLICANT INFORMATION section of a financial application is a crucial step for users applying for credit. This guide provides comprehensive, step-by-step instructions to ensure that users can accurately complete this section online, making the process as smooth as possible.

Follow the steps to fill out the co-applicant information accurately.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the co-applicant’s legal name in the designated field, ensuring to include the last name first, followed by the first name, middle name, and suffix if applicable.

- Provide the co-applicant's social security number in the corresponding field. Double-check for accuracy, as this information is essential for credit assessment.

- Indicate whether the co-applicant is a US citizen by selecting 'Yes' or 'No' in the appropriate box.

- Input the co-applicant's home phone number to maintain contact. Make sure to include the area code.

- Fill in the co-applicant's date of birth using the format specified in the form to avoid any errors.

- Enter the co-applicant's county of residence. This is typically the county where the co-applicant lives.

- Provide the full street address of the co-applicant, including the city, state, and zip code, to ensure proper identification and correspondence.

- Review all entered information for accuracy and completeness to prevent delays in the application process.

- After completing the co-applicant section, save your changes. You may choose to download, print, or share the form as needed.

Begin the process of completing your documents online today.

Having a co-borrower has many advantages. For one, it can allow you, as the borrower, to qualify for a larger loan amount since both the borrower and the co-borrower's income, assets, and credit histories are factored in.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.