Loading

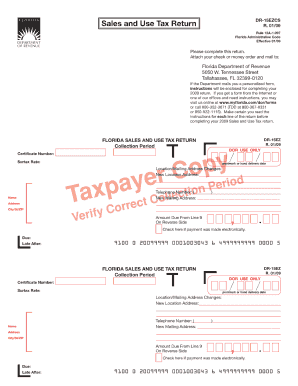

Get Dr 15ezcs Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 15ezcs Form online

Filling out the Dr 15ezcs Form online can be a straightforward process if you follow the right steps. This guide provides clear instructions to assist you in completing the form efficiently and accurately.

Follow the steps to fill out the Dr 15ezcs Form online.

- Click the ‘Get Form’ button to obtain the form and open it in the document editor.

- Begin by providing your personal information in the designated fields, ensuring to include your full name, address, and contact details as requested.

- Next, review the sections regarding your eligibility. Answer each question accurately, as this will determine the processing of your form.

- Fill out the financial information section carefully. Be prepared to include any relevant income details or financial statements as necessary.

- If applicable, complete the section on supporting documentation. Check the requirements to see what documents you need to attach or submit.

- Once you have filled out all the necessary sections, review your information for accuracy. Make any necessary corrections before proceeding.

- After verifying your entries, you can save changes, download, print, or share the completed form, depending on your preferences.

Complete your documents online for efficiency and ease.

To amend a Florida sales tax return, you will need to complete a new return for the specific period and indicate that it is an amended return. This process ensures that the Florida Department of Revenue receives your correct information, and it's critical for maintaining compliance. Make sure to include accurate details and explanations for changes made. The Dr 15ezcs Form provides a straightforward way to facilitate this amendment process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.