Loading

Get Form Tt 8

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form TT-8 online

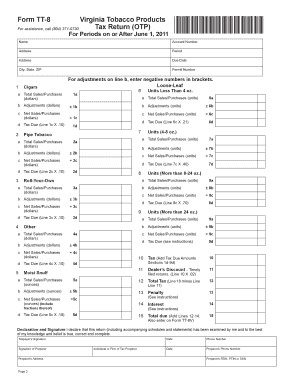

Filling out the Form TT-8, Virginia Tobacco Products Tax Return, online can streamline the process of submitting your tax information. This guide provides users with clear, step-by-step instructions to ensure all sections of the form are completed accurately.

Follow the steps to successfully complete the Form TT-8 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor. This initial step is essential for retrieving the document you need.

- Complete the taxpayer information section at the top of the form, including your name, account number, address, period, and permit number. Ensure that all details are accurate to avoid complications.

- For lines 1 through 4, report the total sales in dollars for cigars, pipe tobacco, roll-your-own tobacco, and other products. If any adjustments are needed, deduct these from the total and indicate them in brackets.

- Calculate the net sales/purchases by adding or subtracting the adjustments on the relevant lines (1c, 2c, 3c, etc.). Make sure to double-check your calculations for accuracy.

- Determine the tax due for each category by multiplying the net sales/purchases by the applicable tax rate (10% for most categories). Enter these figures in the designated tax due fields.

- For moist snuff, report the sales based on weight in ounces. Calculate the tax based on the weight sold using the specified rates. Take care to handle any necessary adjustments accurately.

- Complete lines for loose leaf tobacco according to the weight categories specified, ensuring that each is calculated correctly based on the corresponding tax rates.

- Sum all the tax due amounts from each category on line 10. Apply any dealer’s discounts if applicable and compute the total tax due, including penalties or interest if payment is late.

- Sign and date the declaration section of the form, confirming that all information is true and complete. If applicable, the preparer should also sign and provide their details.

- Once all sections are completed, save your changes. You can choose to download and print the form for your records or send it electronically as required.

Take the time to fill out your Form TT-8 online today and ensure your tax obligations are met smoothly and efficiently.

To fill out form 6781, carefully review the form's instructions provided by the IRS. Ensure you follow each step methodically, paying close attention to the details required for accurate reporting. If you have questions or need templates, you can visit uslegalforms for assistance with Form Tt 8 and related forms, making the process smoother.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.