Loading

Get Business Credit Application - The Lumberzone - Thelumberzone

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Credit Application - The LumberZone - Thelumberzone online

Navigating the Business Credit Application can be straightforward with the right guidance. This document serves as a detailed, step-by-step guide to assist users in successfully completing the application online.

Follow the steps to fill out the Business Credit Application effectively.

- Press the ‘Get Form’ button to access the application form and open it in your preferred editor.

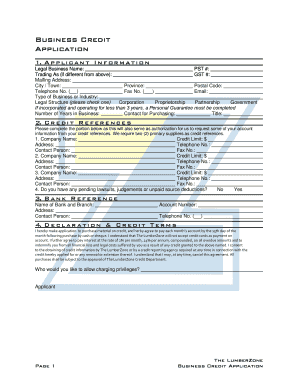

- Begin with the 'Applicant Information' section. Provide the legal business name, PST number, and if applicable, the trading name. Fill in the GST number as well.

- Complete the mailing address fields, including city, province, postal code, and telephone number. If there is a fax number, include that as well.

- Indicate your email address and specify the type of business or industry you operate in.

- Select the legal structure of your business by checking the appropriate box: Corporation, Proprietorship, Partnership, or Government. If your business is incorporated and has been operating for less than three years, ensure a Personal Guarantee is completed.

- Enter the number of years your business has been operating and provide the contact person for purchasing, along with their title.

- In the 'Credit References' section, list two primary suppliers as your credit references, along with their details including company name, credit limit, address, telephone number, contact person, and fax number. You may provide information for a third or fourth supplier if applicable.

- Answer the question about pending lawsuits, judgments, or unpaid source deductions by selecting either 'No' or 'Yes'.

- Next, fill out the 'Bank Reference' section with the name of your bank and branch, along with their contact person, address, account number, and telephone number.

- In the 'Declaration & Credit Terms' section, read through the agreement. Confirm your consent to the terms by providing your signature, along with the date. If applicable, also provide the store manager’s signature and date.

- Finally, indicate the credit limit you are requesting and any specific project details, if necessary. Save your changes, download, print, or share the completed application as needed.

Complete your Business Credit Application online today to access the resources you need for your business.

A business credit profile is a characterization of your business's credit history that establishes its ability to borrow. Your business credit score is a reflection of your business's creditworthiness and influences your access to credit products such as credit cards and loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.