Get South Dakota 501c3 Reporting Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the South Dakota 501c3 Reporting Form online

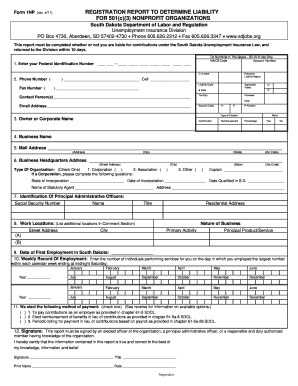

Filling out the South Dakota 501c3 Reporting Form online is a crucial step for nonprofit organizations to determine their liability under the state's unemployment insurance law. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Press the 'Get Form' button to obtain the form and open it in your preferred digital editing tool.

- Begin by entering your Federal Identification Number in the designated field.

- Provide your phone number and fax number, if applicable. Ensure all contact information is current for effective communication.

- Skip the section labeled 'Do Not Write In This Space – SD DLR Use Only' as this is for the South Dakota Department of Labor’s use.

- Input your business name and owner or corporate name in the specified fields.

- Fill in your mail address and business headquarters address, including street, city, state, and zip code.

- Select the type of organization from the options provided (corporation, association, or other), and fill in additional details if you selected 'corporation'.

- Identify the principal administrative officers by providing their names, titles, and residential addresses along with their Social Security Numbers.

- List additional work locations and specify primary activities and principal products or services provided.

- Enter the date of first employment in South Dakota.

- Complete the weekly record of employment by entering the number of individuals working for the organization during the largest employment week.

- Choose your preferred method of payment by checking the corresponding box. Review the explanations provided to understand your options.

- The report must be signed by an authorized officer of the organization. Ensure the signature, title, printed name, and date are included.

- Once all sections are completed, you can save changes, download, print, or share the filled-out form as needed.

Start preparing your South Dakota 501c3 Reporting Form online to ensure compliance and smooth operations.

Starting a 501c3 in South Dakota involves several key steps. You must first create a detailed business plan, draft your bylaws, and form a board of directors. After that, submit the appropriate application forms, including the South Dakota 501c3 Reporting Form, to ensure you meet all state and federal requirements. Utilizing platforms like uslegalforms can simplify this process by providing the necessary templates and guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.