Get R 620ins Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R 620ins Form online

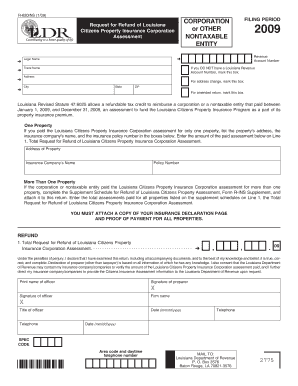

Filling out the R 620ins Form online is an essential step for corporations and nontaxable entities seeking a refund for the Louisiana Citizens Property Insurance Corporation assessment paid during 2009. This guide will walk you through the process, ensuring you provide accurate information for a successful submission.

Follow the steps to complete the R 620ins Form online.

- Press the ‘Get Form’ button to access the R 620ins Form in your digital interface.

- Begin filling out the required fields. Enter your revenue account number in the designated box. If you do not possess a Louisiana Revenue Account Number, mark the appropriate box.

- Input the legal name of your corporation or nontaxable entity, along with the trade name, if applicable. Provide your complete address, including city, state, and ZIP code. If you need to inform about an address change, tick the corresponding box.

- For a refund request concerning one property, list the property's address, the name of the insurance company, and the insurance policy number in the provided boxes. Write the amount of the paid assessment on Line 1.

- If more than one property had an assessment, complete the Supplement Schedule for Refund of Louisiana Citizens Property Assessment (Form R-INS Supplement) and attach it. Sum the total assessments paid for all properties listed on the supplement schedules and enter that total on Line 1.

- You must attach a copy of your insurance declaration page and proof of payment for all properties related to the assessment. Acceptable proof includes cancelled checks, images of checks, or itemized escrow statements.

- Review your completed form thoroughly. Ensure all fields are accurately filled and that necessary documents are attached.

- Sign and date your return. If someone else prepared the form, ensure they also sign it.

- Finally, submit the completed form by mailing it to the Louisiana Department of Revenue at the provided address.

- After submission, consider saving a copy of the form for your records, and monitor for any updates regarding your refund request.

Start completing your documents online today for a streamlined filing experience.

The requirements for an IR56 form include supplying specific employee data, such as the employee's period of employment and remuneration details. By using the R 620ins Form from the US Legal Forms platform, you can ensure all necessary information is captured correctly. Their easy-to-understand guides will assist you in meeting all compliance requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.