Get Illinois Department Of Revenue 1120 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Department Of Revenue 1120 Form online

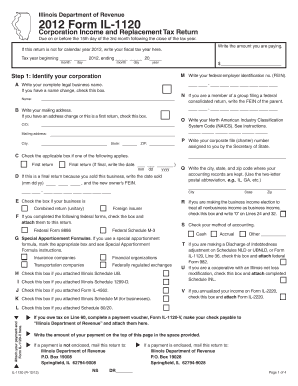

Navigating tax forms can be challenging, but filling out the Illinois Department Of Revenue 1120 Form online does not have to be. This guide offers clear and supportive instructions for users at all experience levels to successfully complete this important document.

Follow the steps to complete the 1120 form online.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editing platform.

- Begin by identifying your corporation. Enter your complete legal business name in the designated field. If there has been a name change, ensure to check the appropriate box.

- Provide your mailing address. If it’s a first return or if the address has changed, make sure to check the corresponding box.

- Fill in any relevant details about your corporation, such as checking if it is your first or final return, and indicating a sale date if applicable.

- Complete the section detailing the federal employer identification number (FEIN) and the North American Industry Classification System (NAICS) code. Ensure to prepare the necessary supporting documents for the details you enter.

- Proceed to the income or loss section, following the prompts to enter amounts from your federal return and making necessary deductions.

- Continue by calculating your base income or loss and making any applicable adjustments as prompted by the form.

- Attach any required schedules as instructed for specialized situations such as nonbusiness income or trust income.

- Complete the sections regarding the figure for net income, replacement tax, and income tax after credits, ensuring all calculations are accurate.

- Finally, sign the form in the designated area. Review your entries one last time before saving your changes. You may then choose to download, print, or share the completed form.

Begin filling out the Illinois Department Of Revenue 1120 Form online today for a smooth filing experience.

To determine if you are exempt from federal and Illinois income tax withholding, review your financial situation from the previous year. If you had no tax liability and expect to have none this year, you may qualify for an exemption. Complete the required forms to claim this status and submit them to your employer. For assistance, consider using resources from the Illinois Department Of Revenue or consult a tax professional.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.