Get State Income Tax Returns And Part-year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Income Tax Returns And Part-year online

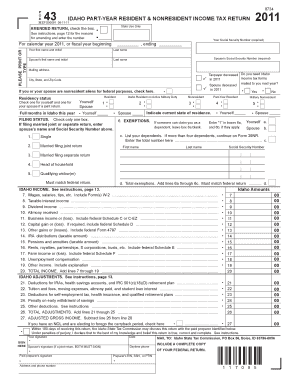

Filing your state income tax returns can be a complex task, especially if you are a part-year resident or nonresident. This guide will provide you with a comprehensive and clear approach to filling out the State Income Tax Returns And Part-year form online, ensuring that you meet all necessary requirements.

Follow the steps to complete your tax return efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security Number in the designated field. This is required for the form to be processed correctly.

- Specify the calendar year for which you are filing. For example, write '2011' if that is your tax year.

- Fill in your name and initial as well as your spouse's name and Social Security Number if you are filing jointly.

- Indicate your mailing address, ensuring that all fields are completed, including city, state, and zip code.

- Select the residency status for both you and your spouse, checking the appropriate boxes for either resident, nonresident, or part-year resident.

- For filing status, check only one box that corresponds with your situation, whether single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Provide the number of exemptions you wish to claim. This includes listing any dependents you have.

- Report your Idaho income. You will fill in various income sources such as wages, taxable interest, and any business income. This section may require input from federal forms.

- Complete the Idaho adjustments section, where you can list any deductions or adjustments applicable to your situation.

- Calculate your total tax using the specified lines for additions and subtractions from your income. Ensure you refer to the instructions for proper calculations.

- Review the donation sections if you wish to contribute to any funds indicated on the form.

- Finalize your document by signing and dating the form at the designated areas. If filing jointly, ensure both parties sign.

- After reviewing all entered information, save your changes, download, print, or share your completed form as needed.

Start filling out your State Income Tax Returns And Part-year online today for a seamless filing experience.

Form 540 2EZ is a simplified tax form for California residents with straightforward tax situations. This form allows individuals to report their income easily and determine their California income tax liability quickly. If your circumstances align with the requirements, using Form 540 2EZ can simplify your state income tax returns and part-year process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.